All About Bill of Entry & How to Automate Data Extraction from BOE

What is a Bill of Entry?

Bill of Entry meaning BOE filing by exporters or importers on or before the arrival of the shipment of the imported goods. BOE plays a major role in the clearance of the shipment as it has to be submitted to the Customs department.

BOE India shall be raised for both household consumption goods and bond clearance. The acronym of Bill of Entry is BOE full form which is a document that is legally that is acceptable in the eyes of the law. In this article we’ll discuss BOE in shipping, bill of entry format, bill of entry in import, what is BOE, bill of entry status, bill of entry payment, types of bill of entry, and much more.

When Bill of Entry Shall be Filed?

When a seller imports from other countries a legal document is filed by the importer or a customs agent on the arrival of goods. This legal document we called a bill of entry in Import. This bill of entry document is an important part of the customs clearance procedure and is submitted to the customs department.

The bill of entry can be issued either for home usage. Because after issuing a bill of entry in GST, the importer can claim ITC on the goods.

Who Needs to Issue Bill of Entry?

The following person needs to issue a BOE number format

- Importers - who import goods from the foreign country

- Seller - who sells goods after purchasing

What is the Customs Bill of Entry Clearance Procedure

The authorized officer will examine the shipment after the Bill of Entry (BOE) is furnished. Afterward, for clearing the shipment from customs the importer or exporter has to pay the customs duty, IGST, and CESS applicable. The importer or exporter can claim a refund of GST and CESS paid but custom duty in the bill of entry meaning cannot be claimed back.

Process in Bill of entry payment includes

- Filled the form

- Examination of goods from the custom officer

- Pay the duty to claim the ITC for the Bill of entry in the GST

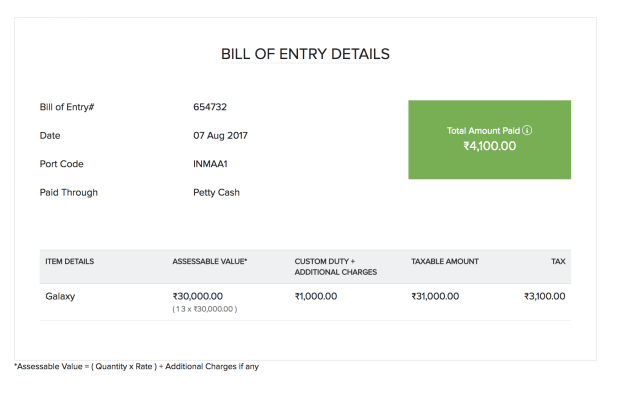

Bill Of Entry Format

As per the guidelines of the government, here is what the bill of entry format looks like under the GST regime:

Content of Bill Of Entry (BOE)

Port Code and License Number

- IEC (Import Export Code)

- Customs House Agent Code

- Import/exporter name and address

- Port code and license number

- Country of origin and its code

- Country of consignment and its code

- Port of shipment

- The importer's or exporter's address will get auto-filled in case if the taxpayer is registered.

NOTE: In the IEC field the taxpayer needs to enter their GSTIN or provisional GSTIN. In case the taxpayer does not have regular or provisional GSTIN, he/she can use their PAN/UIN. It shall be noted that the GST refund will be given based on this. - Name of the Vessel, country of origin and its code, country of consignment and its code, shipment court, and landing bill date.

- Details of goods

- Quantity of goods

- Goods description, serial number, and unit code of goods

- Package weight and value

- For every class, there should be a different goods description

- Tariff of custom consisting of exemption notification and year

- Customs duty

- Duty code nature

- Landing and handling charges along with the assessable value of the goods

- Basic customs duty applicable

- Tax Levied is the actual bill of entry payment you made

- IGST along with code, rate, and amount

- Amount of CESS

- Exemption notification for claiming exemption from IGST and compensation CESS

- The total amount of duty in words and the total number of packages in words

- Two declarations and signatures for the customs officer or Agent and importer/exporter. Only after both these parties sign the bill, the bill becomes valid and verified.

- Below Image is a bill of entry example

How Can One Track the Bill of Entry Status?

One needs to go to the ICEGATE website an online filing service website for traders as well as logistic cargo operators. This would also help the exporters and traders in tracking the clearance status of various goods in different services provided by the ICEGATE website. Tracking the ICES or Indian Customs EDI system through the ICEGATE portal is very easy and simple.

Follow the steps to track the Bill of Entry Status

- Go to the ICEGATE Portal or website: https://enquiry.icegate.gov.in/enquiryatices/beTrackIces

- Choose the Port code using from the dropdown menu

- Input your Shipping Bill number and date

- Also the Captcha in the required fields.

- Hit the “Submit” button.

- The status or details will get displayed.

Current Problem With the Bill of Entry Import Document

- Too many Fields

- Bill of entry status update time is long due to document length

- Document is lengthy

- Time taking

- The cluttered document makes it difficult to entry

To download the online bill of entry into Excel, then visit the Masters India Bill of Entry PDF to Excel converter Tool.

Frequently Asked Questions

What is a bill of entry?

It is a legal document that permits a seller to sell goods in a country that is imported from a foreign country.

Why do we need a bill of entry?

Will of entry need require for the below need

- To permit goods sold in a country

- Help the authority to check the goods

- Its a kind of authentication like the good is not illegal

- Help in charge the tax amount

- Good for the nation in collecting tax

How many types of bill of entries are there?

There are three types of Bill of entry.

How do you check if a BoE is filed or not?

You can track the Bill of entry status by visiting the website.

What is bill of entry and its types?

Bill of entry types

- Bill of Entry for House Consumption.

- Bill of Entry for Warehousing.

- Bill of Entry for Ex-Bond Goods.

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...