Normally As soon as, you are done with GSTR-1 and GSTR-2, GSTR-3 asks you to proceed for GST payments. But upto 31-03-2018 GST needs to be paid along with GSTR-3B Return filing.

You can also claim refunds by online filing the applicable refund forms. Here, you will know GST rebate increase, GST rebate, GST return on electronics, are GST payments going up in 2022.

The article takes you deeper into both the aspects and gives you an exhaustive view of it

GST Payments/Remittances:

- Which are the heads for paying GST?

- How is a GST payment calculated?

- Who is liable to make a GST payment?

- When is a GST payment made?

- How is a GST payment made?

- What is an electronic ledger?

- What is the penalty on a delayed or non-payment of GST?

GST Refunds:

GST Payments / Remittances:

1. Which are the heads for paying GST?888888

The taxes in GST are broadly divided into three categories:

- CGST - Applies on intra-state transactions and revenues go to the Centre.

- SGST - Applies on intra-state transactions and revenues go to the State.

- IGST - Applies on inter-state transactions and revenues go to the Centre.

Additionally, a registered GSTIN holder is also required to pay TDS [Tax deducted at source] and Reverse Charge under different circumstances.

2. How is a GST payment calculated?

The following calculationis made to arrive at the net payable GST:

- [Total GST minus TDS/TCS] minus penalties and interest [if any] = Net payable GST

The penalties, interest and late fine are to be paid in cash and Input Tax Credit can not be claimed on these.

The computation mechanism of GST payment differs for a regular tax payer than a composite dealer.

Regular tax payer: A regular tax payer is supposed to pay GST on the outward supplies and claim Input Tax Credit for his purchases. The difference of outward tax liability and the Input Tax Creditis the net GST to be paid by a regular dealer.

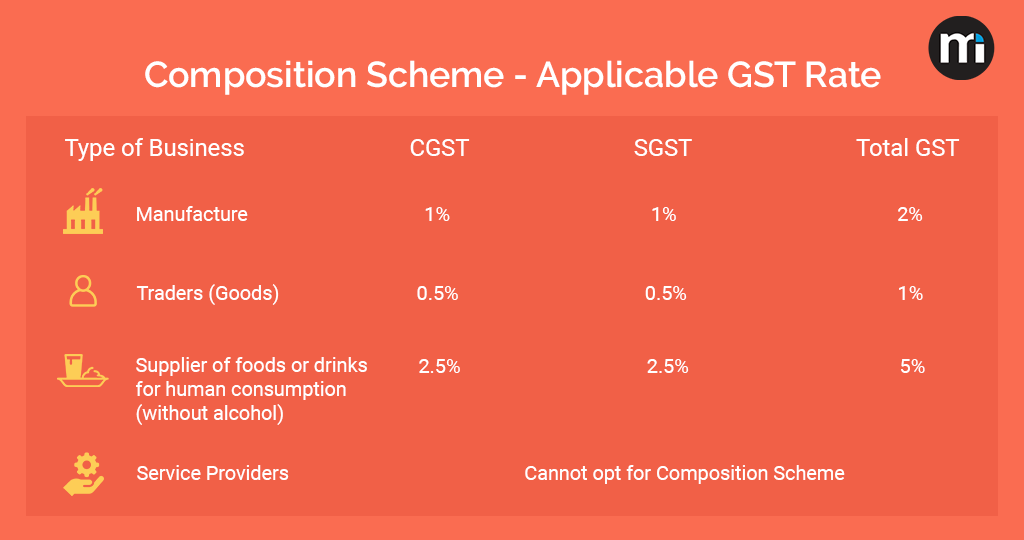

Composite Dealer: The computation of GST for a composite tax payer is relatively easier and he has to pay a fixed percentage of GST on his outward supplies. Different businesses attract different percentages.

3. Who is liable to make a GST payment?

The following merchants are liable to pay GST:

- A registered dealer.

- A registered dealer attracting reverse charge.

- An e-commerce operative is liable to collect TCS and pay TDS / TCS.

- Dealers who deduct TDS / TCS.

- Composition Taxpayers

- Casual Taxpayer

- OIDAR Taxpayer

- NRI Taxpayer

4. When is a GST payment made?

Normally GST is to be paid at the time of filing GSTR-3, i.e. by 20th of the corresponding month. But upto March GST needs to pay along with GSTR-3B return filing.

There are two ways to pay GST:

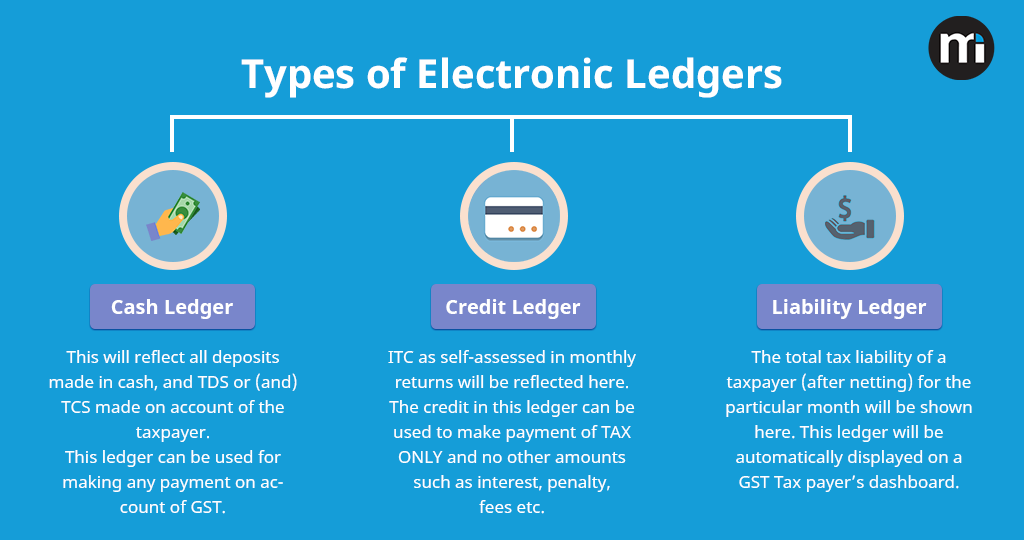

- Paying through credit ledger: The ITC can be availed only for payment of tax and not for paying penalties and interests.

- Paying through cash ledger: After generating the challan at the GST portal, the payment can be made online or offline up to Rs. 10000 through OTC. For tax liabilities exceeding Rs. 10000, it can only be paid online.

6. What is an electronic ledger?

There are broadly 3 types of electronics ledger on the GST portal.

7. What is the penalty on a delayed or non-payment of GST?

Should the GST be shortly paid, paid late or unpaid, a penalty of 18% is levied on the merchant.

GST Refunds:

A GST refund is the reversal of the excess GST paid than the actual liability. The GST Council has set an online process with specific guidelines and timelines for this.

Notification:

GST Refunds Automation for Exporters and Suppliers to SEZ may Start from June

The exporters of goods or/and service along with suppliers to Special Economic Zone (SEZ) units or developers may receive GST refunds automatically from June. This may happen as the Department of Revenue is considering to introduce faceless scrutiny of refunds that will, in turn, help the faster settlement of claims.

Presently, the exporter and supplier to SEZ units have the options through which he/she can claim GST refund for zero-rated goods

- Either by exporting the goods or/and services without payment of IGST under LUT or BOND and claim a refund of accumulated ITC (Input Tax Credit). Or

- He may export or supply goods or/and services to SEZ units on payment of IGST and claim refund thereafter.

Howsoever, any manufacturing exporters and suppliers to SEZ units or developer have to furnish Form GST RFD-01A on the GST portal to claim Input Tax Credit (ITC). Afterwards, he/she has to submit a print out of this form together with other documents to the jurisdictional officer and then the refund is given. The major drawback in this system of refund is that it takes a considerable amount of time and energy of the applicant to receive the refund. This delay in GST refund claims to block the working capital of exporters or suppliers as the refund amount of exporters are in crores figure.

Moreover, there has been a buzz that the GSTN Network and RBI servers will be integrated so as to track the payments as well as to link them with invoice level data.

2. When can a GST refund be claimed?

Some of the instances, where a GST refund is applicable are as follows:

- Dealer exports including deemed exports with goods / services under claim of refund.

- Purchases made by embassies and UN bodies can claim for GST refunds on their purchases.

- Purchases made by International Tourists are subject to GST refunds.

- ITC accumulation due to output being tax exempt or nil-rated.

3. How to calculate a GST refund?

A simple example explains this.

If your tax liability was Rs. 1000 and you paid Rs. 10000 erroneously, you can claim the refund balance of Rs. 9000 in 2 years from the date of payment.

4. What is the deadline to claim a GST refund?

Though the generic timeline for claiming the refund is two years from the date of payment, the dates vary for different circumstances. Some of them are as follows:

Reason for claiming GST Refund |

Relevant Date |

|

Excess payment of GST |

Date of payment |

|

Export or deemed export of goods/ services |

Date of dispatch/loading/passing the frontier |

|

ITC accumulates as output is tax exempt or nil-rated |

Last date of financial year to which the credit belongs |

|

Finalization of provisional assessment |

Date on which tax is adjusted |

Should there be a delay on the government’s part to pay the refunds, an interest of 24% p.a. is to be paid by the government to the dealer.

Form RFD 01, authorized by a Chartered Accountant is to be filed within 2 years from the said date to claim a GST refund.

GST refund can also be claimed effortlessly through autoTax, the GST compliance software from Masters India.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement