Invoices under GST

Invoices

This article discusses the following in detail:

What is a GST Invoice?

A GST invoice is a document that will capture all the relevant details of a business transaction including information about both parties. It will comprise the product name, description, quantity, details of the supplier, purchaser, the rate charged, discounts, terms of sale on approval basis under GST, etc.

Invoice under GST would be the principal document on which other documents such as trial balance, P&L A/C and balance sheet would rely on. A purchaser would be able to claim input credit only if the GST invoices are in order.

In this article we are going to deal with two types of documents – Tax Invoice and Bill of Supply.

Tax Invoice

A tax invoice is a document that is issued when a taxable person supplies any product or service.

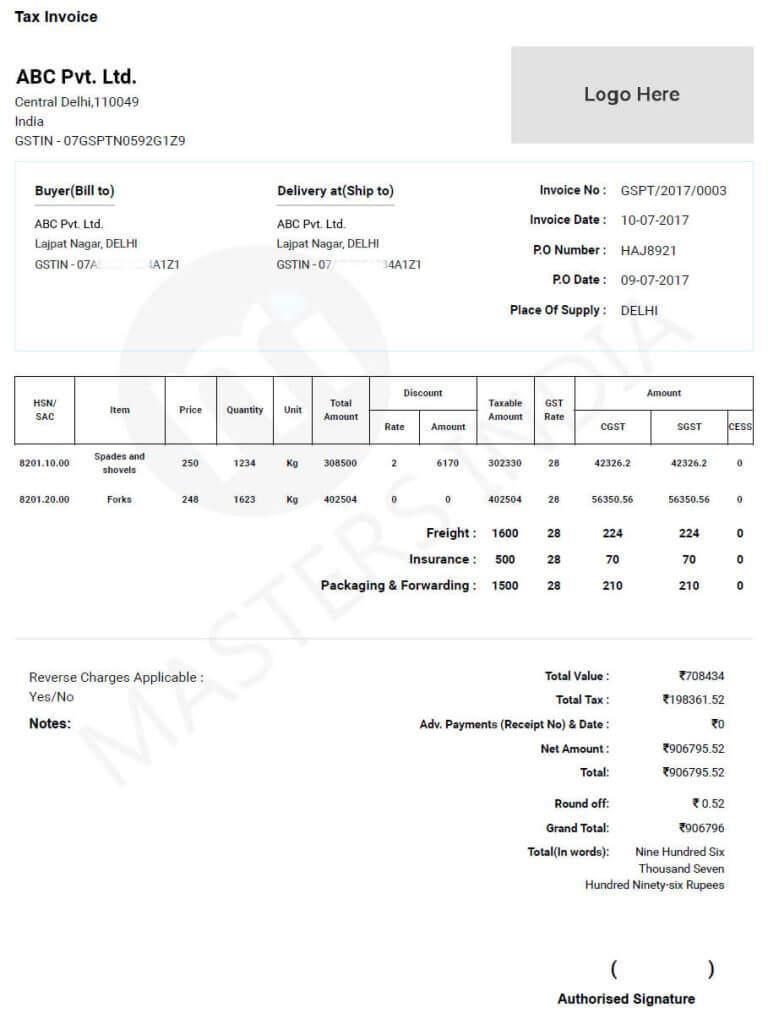

A sample GST invoice would look like this:

Bill of supply

One of the primary motives of a tax invoice is to charge the tax from the purchaser on behalf of the government. However, there are few exceptions to this in GST, wherein a supplier is prohibited from charging tax and so a regular tax invoice cannot be issued. In such cases, the document which is to be used is called a Bill of Supply. The Bill of supply is issued, in the following cases:

-

When supplying exempted goods or services

-

When the supplier is paying tax under composition scheme

Time Limit to Issue an invoice:

The time period to issue an invoice under the prescribed rules varies between goods and services and is dependent on the nature of the supply. This has been explained below:

Taxable Goods:

-

Where supply involves movement of goods: Invoice to be issued before or at the time of removal of goods

-

In any other case: Invoice to be issued before or at the time of delivery of goods or making available to the recipient.

Taxable Services:

Invoice to be issued within 30 days from the date of provision of services.

Reverse Charge:

A registered taxable person who is liable to pay tax under reverse charge shall issue an invoice in respect of goods/services received by him, on the date of receipt of goods/services from a person not registered under this act.

Continuous Supply of Services:

-

Due date of payment ascertainable: Invoice to be issued on or before the due date of receiving the payment

-

Due date of payment not ascertainable: Invoice to be issued on or before the supplier receives the payment

- Payment linked to completion of an event: Invoice to be issued on or before the completion of that event

Supply of Services Ceases under a Contract:

The invoice to be issued when the supply ceases.

Goods Sent on Approval Basis:

Invoice is to be issued at the earlier of the following dates:

-

Before or at the time of supply; OR

-

Six months from the date of removal.

In Case of Banks, NBFC’s and Financial Institutions:

Within 45 days of rendering of the services.

Revised Invoices

A registered taxable person may issue a revised invoice against the invoice already issued by him during the period starting from the effective date of registration till the date of issuance of certificate of registration to him. The revised invoice would enable the recipient to take credit of the tax charged in it.

Apart from the above, there are few other technicalities about invoicing under GST , which you should know:

-

There is no prescribed format for GST invoicing. However, the invoice needs to contain certain prescribed particulars.

-

Retailers have the option of issuing a consolidated invoice of up to Rs. 200/- in respect of all supplies made to an unregistered person in a single day. However, if a customer so demands, separate invoices are to be issued irrespective of the amount of the invoice.

-

A separate Bill of Supply is not required if the VAT invoice is issued for non-taxable supplies.

-

The businesses with a turnover of up Rs. 1.5 crore annually are exempt from mentioning the HSN code in their invoices. W.e.f. 01/04/2021, a registered person with an annual turnover of up to Rs. 5 crore need not mention the HSN code in the invoice in case of a B2C supply.

Copies of Tax Invoices

Three copies of a tax invoice are generated whenever they are issued.

Original Copy:

This is the first copy of the invoice for the buyer and labeled as ‘Original for recipient’

Duplicate Copy:

This is for the transporter to be produced, as and when required, and labeled as ‘Duplicate for transporter’. However, the transporter does not need an invoice if the supplier has an invoice reference number, which can be generated from the Invoice Registration Portal by uploading the details of the relevant tax invoice.

Triplicate Copy:

It is for the supplier's own record.

Once you take the first and major step precisely with the correct invoicing in place, the overall GST process becomes relatively easier. autoTax from Master’s India, a GST Suvidha Provider is a fully automated GST solution, which along with other functionalities also ensures that your invoicing always follow the prescribed GST invoicing guidelines.

Know Your GST, GST Verification, GST Calculator, HSN Code Search, GST Return Status

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...