What is a Balance Sheet?

Balance Sheet is an important part of financial statements that indicates the financial position of an entity at any given point of time. Company balance sheet format India gives a detailed information of it that can be used to know the financial stability and position of such an entity. The balance sheet new format constitutes the reported version of the accounting equation i.e., where assets equate with liabilities plus equities. Investors and creditors normally take help from the latest balance sheet before investing in an entity.

The Important Part of a Balance Sheet

Balance sheet analysis can disclose a lot of information about an entity’s position just like Nykaa balance sheet. The importance of balance sheet is listed down below:

- Assets: Resources in the control of an entity that has future economic value.

- Liabilities: Obligations arises in the business course which may result in the outflow of the entity's resources.

- Equity: The amount invested by the Shareholders in an entity.

Importance of Balance Sheet

Balance sheet analysis can disclose a lot of information about an entity's position. Importance of balance sheet is listed down below:

- Balance sheet acts as a tool that helps the investors, creditors and other stakeholders to analyze an entity's financial health.

- Through comparing different year balance sheets the growth of an entity can be analyzed.

- The balance sheet is a key document which needs to be submitted to the bank in order to process a business loan.

- Position and liquidity of an entity can be easily diagnosed with the help of a balance sheet.

- The balance sheet of an entity helps the owner of such entity to undertake necessary actions such as the expansion of an entity or a project.

The Format of a Balance Sheet

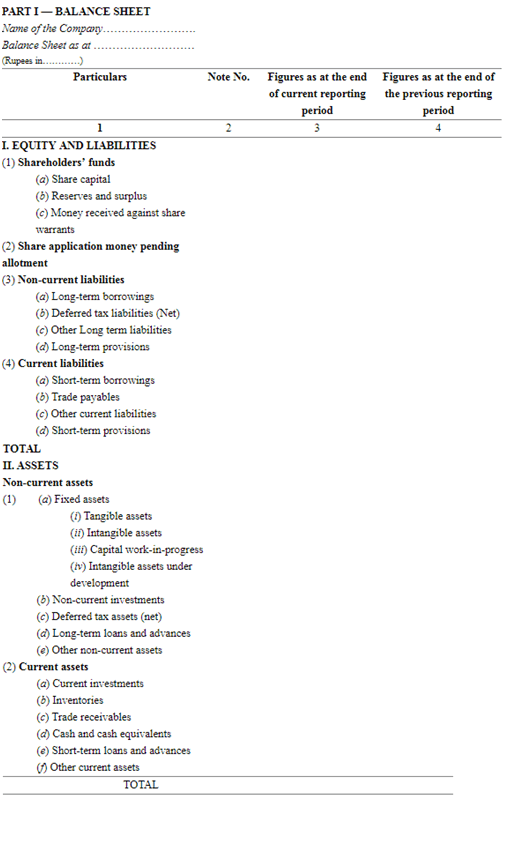

Balance Sheet for Companies

As per the Companies Act 2013, every company is required to make their balance sheet indian format in Vertical format which has Equities, liabilities above and assets in the bottom. Here is the new format of balance sheet which includes balance sheet headers, balance sheet headings, new balance sheet format 2022 which is horizontal balance sheet format.

Balance Sheet for Non Companies

Non companies can follow the old T shape format of Balance sheet which is balance sheet India format as well.

Headings and Sub-headings under the Balance Sheet

| Heading | Sub Heading | Particulars |

|---|---|---|

| Current Assets | Cash | Cash is a part of the current asset and is the most liquid form of these assets. |

| Accounts Receivable | Accounts receivable are the amount that needs to be received from the debtors. | |

| Inventory | Inventory is the items of an entity which is either purchased or manufactured. | |

| Cash Equivalent | These are the items which are not cash but have the same features as of cash. | |

| Fixed Assets | Equipment | Items that are used for handling production or manufacturing work for the long term purpose. |

| Vehicle | Any vehicle owned by an entity. | |

| Land | Land, a part or part thereof, owned by an entity in its own name for more than a year | |

| Plant and machinery | Plants and machinery come under the heading of fixed assets as they can be utilized by an entity to carry out their production or manufacturing work for more than a year. | |

| Intangible Assets | Goodwill | Goodwill comes under the heading of an intangible asset that shows future value of an entity. |

| Patent, copyright and trademark | These fall under the heading of intangible assets and are part of intellectual property rights which save an entity from any authorized use. | |

| Current Liability | Accounts Payable | Accounts payable are such amounts that are not yet paid to creditors for services or goods. |

| Outstanding Expenses | Outstanding expenses are such amount that is due but not paid such as outstanding salary or wage. | |

| Taxes Payable | Taxes payable are those amounts which are due and have to be paid to the government. | |

| Long Term Liability | Long Term Debt | Long term debts indicate the total amount due which has to be paid by an entity for more than a year. |

| Equity | Capital | Capital represents the amount invested by the founder or the owner of an entity. |

| Retained Earning | Such amount which is earned and retained by the entity to be used in the business. | |

| Reserves | Amount separated for specific or general purposes of the company. |

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement