GST ANX-2 – Inward Supplies Annexure

GST ANX-2 Complete Details

To file GST RET-1 the taxpayer has to fill annexure 1 and 2, and they are GST ANX-1 and GST ANX-2. We will discuss the same in this article.

This article discusses the following in detail:

What is FORM GST ANX-2?

GST Form 2 is a GST annexure form to the GST RET-1 Form. GST ANX-2 Form consists of all the details regarding the inward supplies. The recipient of such supplies has the power to accept or reject the GST ANX-2 Form. In case if he/she accepts the GST ANX-2 Form then it will imply that the supplies furnished by the supplier in GST ANX-1 are correct.

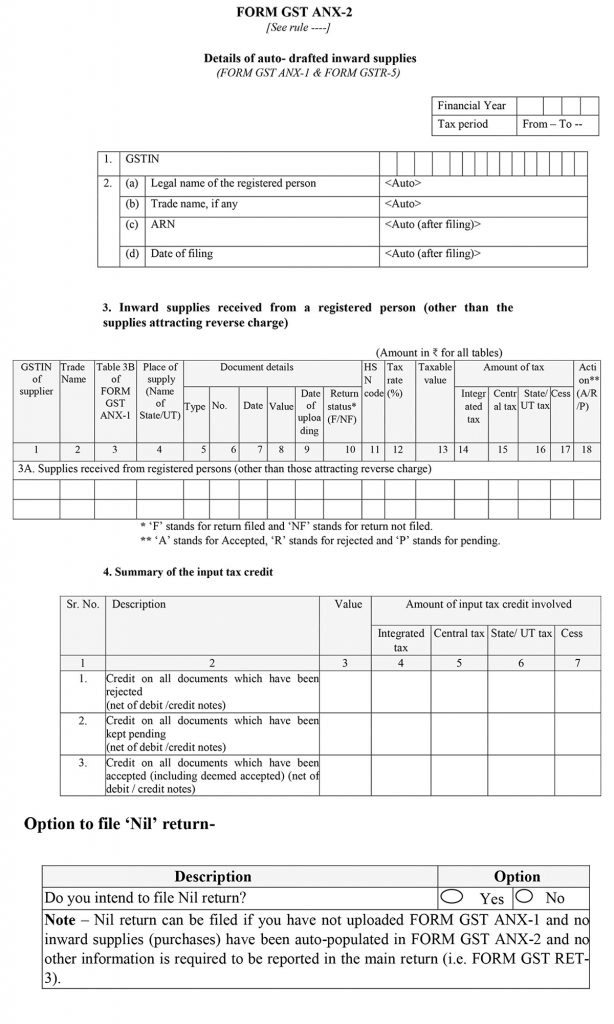

Format of GST ANX-2 Form

Content of GST ANX-2 Form

1. GSTIN

This will contain the GSTIN of the taxpayer which will be auto-populated

2. Other Details

This will contain all the basic details about the taxpayer such as legal name of the registered person, trade name if any, ARN and date of filing. All the fields in this column will get auto-populated on the basis of GSTIN.

3. Purchases from a registered person, imports and supplies received from SEZ on BOE: The different tables under section 3 of GST ANX-2 Form are-

| able Number | Name of the Table | Instructions |

|---|---|---|

| 3A | Supplies received from registered taxpayer consisting services received from SEZ | The following tables will get auto-populated using the following tables of GST ANX-1 Form of supplier: 3B – B2B Supplies except for those attracting reverse charge 3E and 3F – Supplies to SEZ with and without payment of tax 3G – Deemed exports However, the recipient can accept and reject the documents uploaded regarding these details |

| 3B | Import of goods from SEZ units/developers on Bill of Entry | |

| 3C | Import of goods from overseas on BOE |

4. ITC Summary

This table will contain the consolidated information regarding ITC for the period of filing that depends upon the action of the recipient of the document received from GST ANX-1 Form:

- ITC of the documents that have been rejected

- ITC of the documents that are in the pending state

- ITC of the documents that have been accepted

5. ISD (Input Service Distributor) credits received

In this section, the recipient needs to furnish all the details regarding the ITC received by him from the ISD (Input Service Distributor). The recipient needs to enter the details of ITC form ISD document wise.

Things to remember at the time of filing GST ANX-2 Form

Here is the list of things that a taxpayer should remember at the time of filing GST ANX-2 Form

- The details in the form GST ANX-2 Form will be auto-populated through GST ANX-1.

- The documents uploaded by the supplier in the Form GST ANX-1 will be available in GST ANX-2 Form to accept, reject and pending.

- In case if the recipient accepts the document before filing GST RET-1 form that means the details entered by the supplier are fair and true.

- The recipient cannot make any amendment in the Form GST ANX-1 through GST ANX-2 Form; the only supplier can amend the details in the GST ANX-1 Form.

- In case if a recipient has kept any document that means he/she has kept the document on hold to take any action on a later date or time. Thus, ITC of such documents will not reflect in GST RET-1 Form.

- The supplier cannot amend any pending documents or invoices until they are rejected by the recipient in their GST ANX-2 Form.

- The recipient will get to know whether the supplier has filed the GST RET-1 or not through GST ANX-2 Form. However, it shall be noted that it will not impact the eligible ITC of the recipient that will be decided as per the rules of the GST Act.

- A separate functionality will be introduced in the GST system to search for rejected and accepted documents on which the ITC has already been claimed.

- Once the GST RET-1 Form is filed; GST ANX-2 form will also be deemed filed for that particular tax period.

- The recipient will not be able to take ITC (Input Tax Credit) through his GST ANX-1 on those documents that are uploaded by the supplier in his GST ANX-1 form but he has not filed his return for the last two consecutive periods. In case if the supplier is filing a return quarterly then for him 2 consecutive periods will be one quarter.

For more details regarding GST ANX-2 form, you can get the help of site:www.mastersindia.co. Here, you can find complete solution regaring GST return forms.

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...