Form GST RET-1 Summary

The GST council has introduced GST RET-1 to simplify the monthly or quarterly task of a taxpayer. Previously, a taxpayer had to file two monthly GST Return GSTR-3B and GSTR-1. Whereas under the new GST Return system there will be only 1 GST Return that will be GST RET-1 that will consist of two different annexure GST ANX-1 and GST ANX-2.

Why GST RET-1 is Required?

GST RET-1 is a smart move that is taken by the Government as it will be a single GST Return whose frequency of filing will be dependent upon the turnover of the taxpayer.

Here are some advantages of GST RET-1 that proves it is a need:

- The taxpayer can upload the invoices on a real-time and continuous basis.

- The compliance cost will also come down due to the simplification of forms and filing procedure.

- The taxpayer now can amend GST Return up to 2 times and can file the same.

GST RET-1 Filing Frequency

The filing frequency of GST RET-1 depends upon the turnover limit of the taxpayer:

- If the turnover of the taxpayer is more than 5 Crore INR in the previous financial year then he has to file GST 1+ RET on a monthly basis.

- Any taxpayer whose turnover is up to 5 Crore INR in the previous financial year then he/she has the option to file GST 1 +RET quarterly

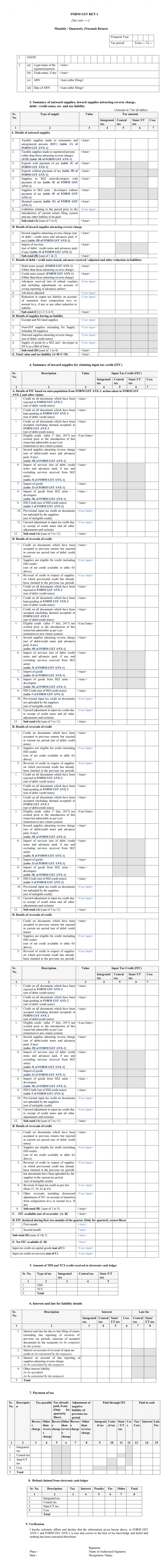

GST RET-1 Form Format

GST RET-1 Form Content

There are 9 parts of new GST RET-1:

1. GSTIN: This will contain the GSTIN of the taxpayer which will be auto-populated

2. Other Details: This will contain all the basic details about the taxpayer such as the legal name of the registered person, trade name if any, ARN and date of filing. All the fields in this column will get auto-populated on the basis of GSTIN.

3. The detailed summary of sale and purchases attracting a reverse charge, CDN (Credit and Debit notes) etc.., Further it shall be noted that the details in this column will get auto-populated through GST ANX-1 Form.

This section has 5 different tables:

| No. | Description | Details |

|---|---|---|

| A | Sales details | In this table the taxpayer has to mention the following details: |

| 1. Taxable supplies made to unregistered person and customers. (Taken from Table 3A of GST ANX-1) | ||

| 2. Sales to any registered taxpayer not attracting a reverse charge. (Taken from Table- 3B of FORM GST ANX-1) | ||

| 3. Details of exports consisting of payment of tax and non-payment of tax. (Taken from the Table 3C and 3D respectively Of GST ANX-1 Form) | ||

| 4. SEZ supplies consisting both with payment of tax and without payment of tax. (Taken from Table-3E and Table-3F of GST ANX-1 Form) | ||

| 5. Deemed exports that get auto-populated from GST ANX-1 Table-3G. | ||

| 6. Any Liabilities for any duration prior to the introduction of the GST RET-1 system or any other liability. | ||

| B | Details of purchases attracting reverse charge | In this table of GST RET-1 Form, the following details will get auto-populated from different tables of GST ANX-1. |

| 1. Purchases attracting reverse charge (Taken from Table-3H) | ||

| 2. Service import details auto-populated from Table-3I | ||

| Note: Value in the above two mentioned cases will be net of Credit/Debit Notes (CDN) and advances on which tax has already been. | ||

| C | CDN issued, advances received/adjusted and other liabilities reduction | In this table the taxpayer has to mention the following details: |

| 1. CDN issued at the time of supply, not including any supplies attracting a reverse charge. | ||

| 2. Advances received on account of supply of services during the period after giving effect to refund vouchers | ||

| 3. Adjustments through advances | ||

| 4. The reduced amount of tax liability due to transfer from composition to normal scheme | ||

| D | Supply not having any liability | In this table the taxpayer needs to enlist the following things: |

| 1. Exempted supplies | ||

| 2. Supplies attracting nil GST rate | ||

| 3. Supplies that are not mentioned anywhere in the GST | ||

| 4. Sale of goods attracting reverse charge | ||

| 5. SEZ supplies to DTA on a BOE's | ||

| 6. Supplies that are not covered under GST or schedule III | ||

| E | The total value of supplies including liabilities | The total value of supplies will be A+B+C+D. On the other hand, the tax liability will get auto-populated |

4. Purchase summary for claiming Input Tax Credit (ITC): To claim input tax credit the taxpayer need to mention all the purchases. The details in this part of the GST RET-1 Form will get auto-filled from GST ANX-1 and ANX-2 Form.

This summary also includes 5 different tables:

| No. | Description | Details |

|---|---|---|

| A | ITC details on the basis of GST ANX-1 and action taken in GST ANX-2 Form. | In this table the taxpayer needs to mention the following details: |

| 1. Any ITC not availed in GSTR-3B can be claimed here | ||

| 2. Provisional ITC on supplies can also be claimed where the supplier is yet to upload the document on. | ||

| The amount that gets auto-populated from GST ANX-2 form: | ||

| 1. ITC amount as per the accepted and rejected documents | ||

| 2. ITC amount as per the pending documents | ||

| 3. ITC distributed by the ISD as reported in GSTR-6 Form | ||

| Fields that get auto-filled from GST ANX-1 Form: | ||

| 1. ITC on purchases attracting a reverse charge as per Table-3H | ||

| 2. Import of services ITC as mentioned in Table-3I | ||

| 3. ITC reported in Table 3J for the import of goods from overseas | ||

| 4. ITC on imported goods from SEZ as mentioned in Table-3K | ||

| B | ITC Reversal Details | The taxpayer needs to mention the following details in this table: |

| 1. ITC that is ineligible | ||

| 2. ITC reversal as per rule 37,39,42 and 43 | ||

| 3. Documents of supplies that were uploaded by the supplier where the ITC was availed by the recipient on the provisional basis. | ||

| 4. Rejected documents by the recipient after filing the return by the supplier. | ||

| 5. Other reversal of ITC | ||

| C | Net ITC claimable after reversal | Difference between A and B above. |

| D | Input Tax Credit mentioned during the first 2 months of the quarter | The details in this table will get auto-filled from GST PMT-08 Form |

| Note: It is for the taxpayer who is filing quarterly return. | ||

| E | Net Input Tax Credit claimable | This table will contain the difference between table C and D. This will get posted to the electronic credit ledger for utilization. |

5. TDS and TCS credit amount received in e-cash ledger: Based on returns filed by TDS deductors in Form GSTR -7 and TCS collectors in Form GSTR-8 amounts will be credited into electronic cash ledger.

6. Details regarding interest and late fee liability: The amount of interest and the late fee will auto-populate that arise due to late filing of return. The taxpayer needs to self-assess all other liabilities.

7. Tax Payment: The amount of tax liability including late fees and penalty has to be made in cash by the taxpayer after utilizing the ITC.

8. Refund claimed from e-cash ledger: The details in this section will get auto-filled from e-cash ledger.

9. Verification: Once every detail in the form is furnished the taxpayer need to verify this by e-signing the return. The taxpayer cannot file the return unless it is verified.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement