What is Place of Supply under GST?

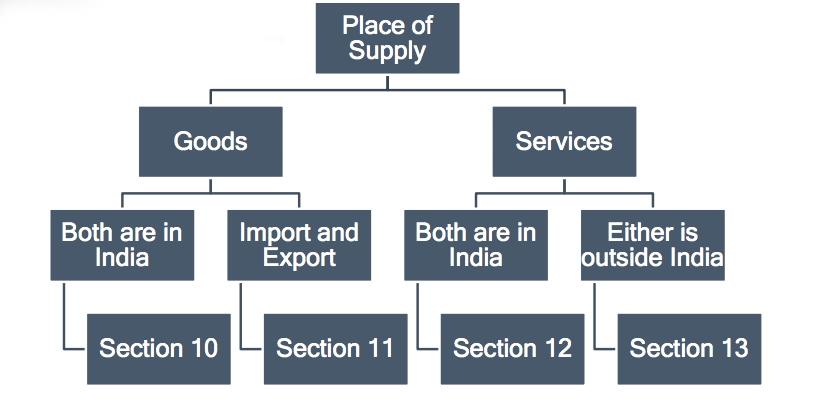

Place of supply determines the place (the State) where the GST shall be received by the government treasury. If the Supplier and place of supply of services under GST section 12 are in same state, it shall be an intra-state supply and CGST and SGST shall be collected by respective government in the state of the supplier. However, in case the Supplier is registered in state A and place of supply falls in other state, it shall be called an inter- state supply and GST shall be transferred to the receiving state by the mechanism of IGST. Thus, it is very important to understand the place of supply of services under GST as to in which state does it exactly falls. Sections 10 to 14 of the Integrated Goods and Services Tax Act details the provisions for place of supply.

We have summarized the provisions hereunder for ready reference.

Define Place of Supply in case of Goods

| Transaction | Section | Place of Supply |

| Where the supply involves movement of goods | Section 10(1)(a) | location of the goods at the time at which the movement of goods terminates for delivery to the recipient |

| Where the goods are delivered by the supplier to a recipient or any other person, on the direction of a third person | Section 10(1)(b) | Place of supply of such goods shall be the principal place of business of such third person |

| Where the supply does not involve movement of goods | Section 10(1)(c) | Location of such goods at the time of the delivery to the recipient |

| Where the goods are assembled or installed at site | Section 10(1)(d) | place of such installation or assembly |

| Where the goods are supplied on board a conveyance | Section 10(1)(e) | Location at which such goods are taken on board. |

| Goods imported into India | Section 11(1)(a) | Location of the importer |

| Goods exported from India | Section 11(1)(b) | Location outside India |

Define Place of Supply in case of Services

| Location of Service Provider | |||

| In India | Outside India | ||

| Location of service recipient | In India | Section 12 of IGST Act | Section 13 of IGST Act |

| Outside India | Section 13 of IGST Act | No tax shall be applicable | |

| Transaction | Section | Place of Supply in case of supply to registered person | Place of Supply in case of supply to other than registered person |

| General Rule | Section 12(2)(a), 12(2)(b) | Location of such registered person | Location of recipient where the address on record exists, and Location of the supplier of services in other cases |

| Supply of services: · in relation to an immovable property including services provided by architects, interior decorators, surveyors, engineers and other related experts or estate agents, any service provided by way of grant of rights to use immovable property or for carrying out or co-ordination of constructionwork, or · by way of lodging accommodation by a hotel, inn, guest house, homestay, club or campsite, by whatever name called and including a house boat or any other vessel, or · by way of accommodation in any immovable property for organizing any marriage or reception or matters related therewith, official, social, cultural, religious or business function including services provided in relation to such function at such property, or · any services ancillary to the services referred to in clause (a), (b) and (c), | Section 12(3) | Location at which the immovable property or boat or vessel is located or intended to be located. | Location at which the immovable property or boat or vessel is located or intended to be located. |

| Restaurant and catering services, personal grooming, fitness, beauty treatment, health service including cosmetic and plastic surgery | Section 12(4) | Location where the services are actually performed. | Location where the services are actually performed. |

| Services in relation to training and performance appraisal | Section 12(5) | Location of such recipient | location where the services are actually performed |

| Service provided by way of admission to a cultural, artistic, sporting, scientific, educational, or entertainment event or amusement park or any other place and services ancillary thereto | Section 12(6) | Location where such event is actually held or where the park or such other place is located | Location where such event is actually held or where the park or such other place is located |

| supply of services provided by way of— (a) organization of a cultural, artistic, sporting, scientific, educational or entertainment event including supply of service in relation to a conference, fair, exhibition, celebration or similar events, or (b) services ancillary to organization of any of the above events or services, or assigning of sponsorship of any of the above events, | Section 12(7) | Location of such recipient | location where the event is actually held |

| services by way of transportation of goods, including by mail or courier | Section 12(8) | Location of such recipient | location at which such goods are handed over for their transportation |

| supply of passenger transportation service | Section 12(9) | Location of such recipient | place where the passenger embarks on the conveyance for a continuous journey |

| services on board a conveyance | Section 12(10) | location of the first scheduled point of departure of that conveyance for the journey | location of the first scheduled point of departure of that conveyance for the journey |

| telecommunication services by way of fixed telecommunication line, leased circuits, internet leased circuit, cable or dish antenna | Section 12(11) | location where the telecommunication line, leased circuit or cable connection or dish antenna is installed for receipt of services | location where the telecommunication line, leased circuit or cable connection or dish antenna is installed for receipt of services |

| telecommunication services in case of mobile connection for telecommunication and internet services provided on post-paid basis | Section 12(11) | location of billing address of the recipient of services on record of the supplier of services | location of billing address of the recipient of services on record of the supplier of services |

| telecommunication services in cases where mobile connection for telecommunication and internet service are provided on pre-payment through a voucher or any other means | Section 12(11) | location where such pre-payment is received or such vouchers are sold | location where such pre-payment is received or such vouchers are sold |

| Other telecommunication services | Section 12(11) | Address of the recipient as per records of the supplier of service | Address of the recipient as per records of the supplier of service |

| banking and other financial services including stock broking services | Section 12(12) | location of the recipient of services on the records of the supplier of services | location of the recipient of services on the records of the supplier of services |

| banking and other financial services including stock broking services when not linked to the account of the recipient of services | Section 12(12) | location of the supplier of services | location of the supplier of services |

| place of supply of insurance services | Section 12(13) | location of such person | location of the recipient of services on the records of the supplier of services |

| Advertisement services to Central Government, State Government, Statutory body or Local authority meant for the States or Union territories identified in the contract or agreement | Section 12(14) | Each such States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the amount attributable to services provided by way of dissemination in the respective States or union territories as may be determined in terms of the contract or agreement or in the absence of the same, such other basis as may be prescribed. | Each such States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the amount attributable to services provided by way of dissemination in the respective States or union territories as may be determined in terms of the contract or agreement or in the absence of the same, such other basis as may be prescribed. |

| Place of Supply in case provider or recipient is outside India. | |||

| General Rule | Section 13(2) | Location of the recipient of services. If it is not available in the ordinary course of business, location of the supplier of service | |

| services supplied in respect of goods that are required to be made physically available by the recipient of service to the supplier of service, or to a person acting on behalf of the supplier of service in order to provide the service | Section 13(3) | Location where the services are actually performed | |

| such services are provided from a remote location by way of electronic means | Section 13(3) | Location of goods at the time of supply of services | |

| services supplied to an individual, represented either as the recipient of service or a person acting on behalf of the recipient, which require the physical presence of the receiver or the person acting on behalf of the recipient, with the supplier for the supply of the service | Section 13(3) | Location where the services are actually performed | |

| services supplied directly in relation to an immovable property, including services supplied in this regard by experts and estate agents, supply of hotel accommodation by a hotel, inn, guest house, club or campsite, by whatever name called, grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including architects or interior decorators | Section 13(4) | Location where the immovable property is located or intended to be located | |

| services supplied by way of admission to, or organization of, a cultural, artistic, sporting, scientific, educational, or entertainment event, or a celebration, conference, fair, exhibition, or similar events, and of services ancillary to such admission | Section 13(5) | Location where the event is actually held | |

| service referred to in sub-sections (3), (4), or (5) is supplied at more than one location, including a location in the taxable territory | Section 13(6) | Location in the taxable territory where the greatest proportion of the service is provided | |

| services referred to in sub-sections (3), (4), (5) or (6) are supplied in more than one State | Section 13(7) | each of the States in proportion to the value of services so provided in each State as ascertained from the terms of the contract or agreement entered into in this regard or, in absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf | |

| services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders | Section 13(8) | Location of the supplier of services | |

| intermediary services | Section 13(8) | Location of the supplier of services | |

| services consisting of hiring of means of transport other than aircrafts and vessels except yachts, upto a period of one month | Section 13(8) | Location of the supplier of services | |

| services of transportation of goods, other than by way of mail or courier | Section 13(9) | Place of destination of the goods | |

| passenger transportation service | Section 13(10) | Place where the passenger embarks on the conveyance for a continuous journey | |

| services provided on board a conveyance during the course of a passenger transport operation, including services intended to be wholly or substantially consumed while on board | Section 13(11) | First scheduled point of departure of that conveyance for the journey | |

| online information and database access or retrieval services | Section 13(12) | Location of recipient of service | |

| In order to prevent double taxation or non-taxation of the supply of a service or for uniform application of rules, the Government shall notify any description of services. | Section 13(13) | Place of effective use and enjoyment of a service. | |

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...