Know What is Reverse Charge Mechanism

In a gigantic country like ours, which was and still is widely predominated by unorganized sectors, which were habituated for tax evading and other tax manipulations, the GST wave has send an electrifying tantrum among them. To curb, control and eradicate such practices, GST embeds a mechanism of Reverse Charge, which leads to bring transparency and an adherence towards it. Reverse Charge is not a GST born phenomenon. It is needed to note that the reverse charge as a mechanism has existed in service tax since a long time and several services were added to the list of services under RCM in GST attracting reverse charge every year during the Union Budget. Similarly, the VAT legislation in many states had provisions dealing with purchases by registered dealers from unregistered dealers. The article aims to explain reverse charge mechanism where everything about the reverse charge mechanism from its inception to after effects under the following broad categories:

What is Reverse Charge?

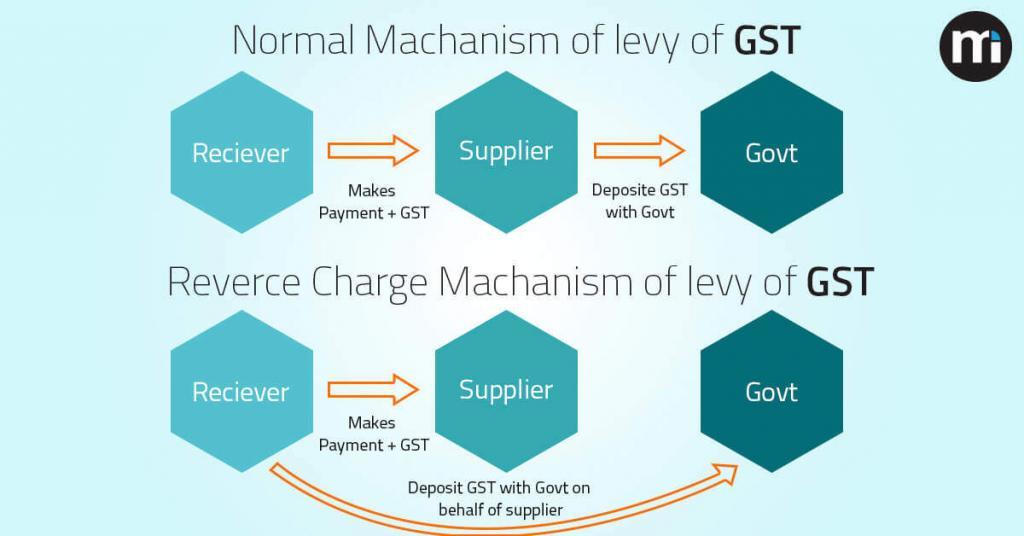

The short note on reverse charge can help you to understand what is Reverse Charge machanism in a better way. Reverse Charge mechanism is a system to monitor and increase the tax coverage, compliance and synchronization and track ability amongst unorganized, partly organized and fully organized sectors. Generally, the supplier of goods or services is liable to pay GST. However, in specified cases like imports and other notified supplies, the liability may be cast on the recipient under the reverse charge mechanism India. Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply.

There are two type of reverse charge scenarios provided in law. First is dependent on the nature of supply and/or nature of supplier. This scenario is covered by section 9 (3) of the CGST/ SGST (UTGST) Act and section 5 (3) of the IGST Act. Second scenario is covered by section 9 (4) of the CGST/SGST (UTGST) Act and section 5 (4) of the IGST Act where taxable supplies by any unregistered person to a registered person is covered.

Why is Reverse Charge important?

The self-policing mechanism of GST is a revolutionary measure in itself considering the pre GST era, where the monitoring and identifying the tax evaders was a real complex phenomenon. The government has injected enough and stringent clauses to address this evasion and simultaneously expand the tax network. The 1st check is that, the input tax can only be availed seamlessly, when the suppliers of a business pay GST. Hence, the buyers will also have an obligation to ensure that their suppliers are paying GST, so that there is no issue while availing the input tax credit. The 2nd check is the reverse charge. The buyer has to bear the tax, when the supplier fails to pay the GST. A blend of these two checks is critical and of extreme importance in getting the absconding and shell business communities till now, into the mainstream.

Why was the Reverse Charge Mechanism Introduced?

If you want to know why RCM is introduced. The logic and need of introducing the Reverse mechanism stems from the fact that, the unorganized business community which is pretty large was unable to pay taxes intentionally or unintentionally [illiteracy, residing in non-taxable territories etc.]. Hence a need of collecting the tax from the service recipient itself cropped up, which when properly formulated was termed as Reverse Charge. Therefore, the basic aim behind introducing reverse charge is to ensure better administration and for the same, as per section 68(2) of the Finance act, 1994, government reserves a right to make not only the service receiver liable to pay service tax rather any other person which the government may notify can be made liable to pay service tax, within the constitutional boundaries.

How did the Reverse Charge in the pre-GST era Worked?

To understand the reverse charge module in the pre-GST or RCM list under GST, let’s start with knowing about the concept of normal charge mechanism, which says that the service provider would be liable to pay the service tax. However, reverse charge mechanism in GST is contrary to this and instead directs the service recipient to bear the service tax. Nutshell, the reverse charge in the pre GST era was similar to its post GST counterpart except for the element of the Input Tax Credit, which did not exist before 1st July’17 [GST launch date]

Where can the Reverse Charge be Applied?

Below are the specific scenarios, which will attract reverse charge:

- Unregistered dealer to a registered dealer

- For such a supply, the registered dealer would be liable to pay the GST on reverse charge basis. However, it would not apply to the exempted supplies.

- Registered dealer to an unregistered dealer. There are 12 services, wherein the service recipient will pay the GST.

- Services of Insurance agents

- Services of a director to a company

- Non-resident service provider

- Services of goods and transport agencies

- Services of advocates / advocacy firms

- Service of arbitral tribunal

- Sponsorship services

- Services of recovery agents / FIs / NBFCs

- Services of transportation on import

- Services of permitting use of copyright

- Services of radio taxi's

- Specific services provided by government or local authority to business entity

What Does the Time of Supply Mean in Reverse Charge?

In case of supplies, where tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates:

- the date of the receipt of goods; or

- the date of payment as entered in the books of account of the recipient; or

- the date on which the payment is debited in his bank account, whichever is earlier; or

- the date immediately following thirty days from the date of issue of invoice.

However, where it is not possible to determine the time of supply as above, the time of supply shall be the date of entry in the books of account of the recipient of supply. For example:

- Date of receipt of goods – 15th March 17

- Date of issue of Invoice by the supplier – 15th March 17

- Date of Entry in books by recipient – 17th March 17

- Date on which payment is debited in bank account – 19th March 17

- Date immediately after following 30 days from the date of issuance of invoice by the supplier – 15th April

- Time of Supply- 15 th March (Date of receipt of goods)

If the supplier is located outside India, then the time of supply shall be the earliest of – ‘When the amount is paid i.e. the date of payment’ Or ‘When the recipient records the payment in his books of account’.

How does Input Tax Credit Work under the Reverse Charge?

A supply recipient can avail the input tax credit on reverse charge, only when the goods and / or/ services are used for / continuation / expansion of business. ITC cannot be used to pay output tax and the payment mode is only through cash under reverse charge.

Exemptions under Reverse Charge

There are some exceptions and exemptions to reverse charge for small miscellaneous transactions from unregistered suppliers with some conditions. The GST Council exempts supplies of goods or services or both received by an registered person from any supplier who is not registered from the whole of the central tax applicable thereon, under sub-section (4) of section 9 of the CGST Act provided the aggregate value of goods / services received by a registered person from any or all the unregistered suppliers do not exceed Rs. 5000/- per day. So, the exemption to reverse charge applies when,

- It should be an intra-state supply.

- Applies to both goods and / or services.

- The registered person should be the recipient of the supply

- Only CGST and / or SGST are exempted and do not apply to a portion of the inter-state supply (i.e. IGST).

- Only applies to RCM exemption from an unregistered dealer and not for any other RCM case. The scenarios, which attract RCM by the nature of the supply rather than the nature of the supplier does not fall into the exempted ones.

- Exemption does not apply, if a single person receives a bunch bills totaling to Rs. 5000+ per day, irrespective of the number of persons, they have come from.

Reverse Charge Miscellaneous Pointers

- A composite dealer falling under the reverse charge mechanism can not avail the input tax credit. Additionally, the dealer is liable to pay tax at normal rates applicable to such supply and not the rate applicable for composition scheme.

- Advance payments are liable to reverse charge mechanism.

- The recipient is liable to pay 100% tax on the supply and not unlike the service tax, where there was a provision of partial reverse charge.

Why Should You Care?

Ensuring your suppliers are GST registered and compliant, is an element for your strict consideration. Because, if they are not, the taxes simply slide to your pockets. Do not try to escape GST by misstating / under-stating your annual revenues to fall below the threshold limits. It would have repercussions and the order book would squeeze with reverse charge in picture and the companies would only like to shake hands with those who have a high GST compliance score. Reverse Charge is just one among the many technical aspects of GST and there is a lot, which you should know, understand and have clarity about. Should you still be confused about it and want to consult an expert, the proficient team at Masters India, a GST Suvidha Provider is here to help. autoTax from Masters India is a fully automated GST Software for return filing, which along with other functionalities also ensures that you always remain in the good books of the government by maintaining a high GST compliance rating. To know more about, on how can you put your taxation life cycle on an auto-pilot, please connect with Masters India at info@mastersindia.co | 9773706840.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement