A Comprehensive Guide to File ITR-2 Form Online

To make the Income Tax Returns filing procedure more straightforward, the Income Tax Department has distinguished assessees into different groups based on their income, source of income and many other factors. Thus, before filing the returns, it becomes imperative for the taxpayer to know the eligibility criteria for the same. In this article, we will discuss the ITR 2 Form in detail.

Learn about the other ITR forms here:

ITR-1 ITR-2 ITR-3 ITR-4 ITR-5

Note: The due date to file ITR-2 (non-audit cases) for the AY 2020-21 (FY 2019-20) is extended to 30 November 2020 for all taxpayers.

Who can file ITR-2?

ITR 2 Form means, it is for Individuals and Hindu Undivided Families (HUFs) earning income other than income from Business or Profession. Individuals or HUFs earning:

- Salary or Pension

- Income from more than one House Property

- Short Term capital gains or Long Term Capital Gains

- Income from Other Sources including income from betting, lottery and other legal means of gambling.

- Income from Foreign Assets

- Any agricultural income exceeding the amount of INR 5000

should file ITR-2. Directors in listed and unlisted companies, Not Ordinary Residents (NOR) and Non-Residents (NR) can file this return too.

Structure of ITR 2

The notified format of ITR 2 for AY 2020-21 can be downloaded here. This has 27 parts that need to be filled (as applicable).

⇒ Part A: General details

- Schedule S: Salary Income details

- Schedule HP: House Property income details

- Schedule CG: Income/Loss from capital gains

- Short-term Capital Gains (STCG)

- Long term Capital Gain

- Information about deduction claimed against Capital Gains

- Set-off of current year capital losses with current year capital gains

- Information about accrual/receipt of capital gain

- Schedule OS: Income from other sources

- Schedule CYLA: Details of Income of the current year after setting off the current year’s losses

- Schedule BFLA: Income Statement after setting off of unabsorbed loss brought forward from previous year

- Schedule CFL: Statement of losses that has to be carried forward to future years

- Schedule VIA: Statement of deductions (from total income) as per Chapter VIA

- Schedule 80G: Donations eligible for deduction u/s 80G

- Schedule 80GGA: Donations for scientific research/rural development

- Schedule AMT: Computation of Alternate Minimum Tax (AMT) payable under section 115JC

- Schedule AMTC: Computation of tax credit under section 115J

- Schedule SPI: Statement of income arising to spouse/minor child/son’s wife or any other person or association of persons that is included in the income of the assessee in Schedules-HP, CG and OS

- Schedule SI: Statement of income which is chargeable to tax at special rates

- 111- The accumulated balance of recognised provident for prior years

- 111A or section 115AD(1)(b)(ii)- Proviso (STCG on shares units on which STT paid)

- 115AD (STCG for FIIs on securities where STT not paid)

- 112 proviso (LTCG on listed securities/ units without indexation)

- 112(1)(c)(iii) (LTCG for non-resident on unlisted securities)

- 115AC (LTCG for non-resident on bonds/GDR)

- 115ACA (LTCG for an employee of the specified company on GDR)

- 115AD (LTCG for FIIs on securities)

- 115E (LTCG for non-resident Indian on specified asset)

- 112 (LTCG on others)

- 112A or section 115AD(1)(b)(iii)-Proviso (LTCG on sale of shares or units on which STT is paid) o 10 (part of 3vi of schedule BFLA)

- STCG Chargeable at special rates in India as per DTAA

- LTCG Chargeable at special rates in India as per DTAA

- 115BB (Winnings from lotteries, puzzles, races, games etc.)

- 115BBDA (Dividend income from domestic company exceeding Rs.10 lakh)

- 115BBE (Income under section 68, 69, 69A, 69B, 69C or 69D)

- 115BBF (Tax on income from the patent)

- 115BBG (Tax on income from transfer of carbon credits)

- Any other income chargeable at a special rate

- Other sources of income chargeable at special rates in India as per DTAA

- Pass-Through Income in the nature of Short Term Capital Gain chargeable @ 15%

- Pass-Through Income in the nature of Short Term Capital Gain chargeable @ 30%

- Pass-Through Income in the nature of Long Term Capital Gain chargeable @ 10% u/s 112A

- Pass-Through Income in the nature of Long Term Capital Gain chargeable @ 10%- under sections other than u/s 112A

- Pass-Through Income in the nature of Long Term Capital Gain chargeable @ 20%

- Pass-through income in the nature of income from other sources chargeable at special rates

- Schedule EI: Details of Exempt Income

- Interest income

- Dividend income from the domestic company (amount not exceeding Rs. 10 lakh)

- Agricultural income for the year

- Other exempt income (including exempt income of minor child)

- Income not chargeable to tax as per DTAA

- Pass-through income not chargeable to tax (Schedule PTI)

- Schedule PTI: Pass-through income details from business trust or investment fund as per Section 115UA, 115UB

- Schedule FSI: Statement of income accruing or arising outside India.

- Schedule TR: Information regarding taxes paid outside India

- Schedule FA: Details regarding any foreign assets held and information of income earned from outside India A1. Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the relevant accounting period A2. Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the relevant accounting period A3. Details of Foreign Equity and Debt Interests held (including any beneficial interest) in any entity at any time during the relevant accounting period A4. Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the relevant accounting period

- Details of Financial Interest in any Entity held

- Details of Immovable Property held

- Details of any other Capital Asset held

- Details of account(s) in which the assessee is having a signing authority (including any beneficial interest) at any time during the relevant accounting period and which has not been included in A to D above.

- Details of trusts, created under the laws of a country outside India, in which assessee is a trustee, beneficiary or settlor

- Details of any other income derived from any source outside India which is not included elsewhere

- Schedule 5A: Apportionment statement of income between spouses as per the Portuguese Civil Code

- Schedule AL: Asset and liability at the end of the year (if income exceeds INR 50 lakhs)

- Details of immovable assets

- Details of movable assets

- Liabilities in relation to Assets

- Schedule DI – Details of investments

⇒ Part B-TI: Computation of Total Income

⇒ Part B-TTI: Computation of tax liability on total income

⇒ Tax Payments: Details of Advance Tax, Self Assessment Tax, TDS, TCS

⇒ Verification: Confirmation that details are factually correct and self-attestation by the taxpayer.

How to file ITR 2?

There are two ways to file ITR-2 Form; either one can file it offline or online.

Offline Filing of ITR-2 Form

- ITR-2 Form can be filed offline by every individual who is above the age of 80 years (Super Senior Citizen).

- A person can file ITR-2 Form offline either by furnishing ITR in paper form or through furnishing a bar-coded ITR-2.

After filing the ITR-2 Form offline, the person gets an acknowledgement slip issued by the Income Tax Department for documentation purpose.

Online Filing of ITR-2 Form

- ITR-2 Form can be filed electronically using digital signature by every assessee falling into this group.

- When the ITR-2 Form is filed online, the acknowledgement is received via email to the registered email ID.

- ITR-2 form does not require the attachment of annexures.

What’s New in ITR-2?

1.Resident But Not Ordinarily Residents (RNORs) and Non-Resident Individuals (NRIs) need to file ITR-2 even if their total income is less than INR 50 lakh.

2.Now on, the assessee should disclose details of:

- Cash deposits above INR 1 crore into current accounts,

- Expenditure incurred above INR 2 lakh on foreign travel,

- Expenditure incurred above INR 1 lakh on electricity.

3.Under the head ‘Income from Other Sources’, details of ‘any other income’ should be filled. Any deductions against ‘income from other sources’ have to be explicitly mentioned.

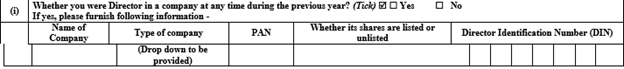

4.The ‘Type of company’ needs to be disclosed in ITR-2 form, in case an individual is a director in a company or holds unlisted equity investments.

5. Schedule 112A has been introduced to show the calculations of the long-term capital gains on the sale of equity shares or units of a business trust, for which STT is applicable.

6.Section 80EEA and section 80EEB are introduced in the ‘Schedule VI-A’.

7.Considering the current pandemic across the country, for this AY only, assessees have an option to claim and disclose tax-saving investments made between 1 April 2020 to 30th June 2020.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement