Form 16A

An individual can have income from sources other than that from his/her salary. This could be interest received on deposits and/or returns from mutual funds, bonds, and investments, rental receipts, commission earned, etc. In some cases, the payer of income may need to deduct tax at source, known as TDS. As mandated by the government, a TDS certificate needs to be issued by the deductor when TDS is deducted. This certificate is furnished in Form 16A India. In layman terms, Form 16A is a TDS certificate that contains the details of:

- Nature of the transaction and

- TDS amount deposited with the IT Department.

In this article, you will find what is form 16a and form 16 format.

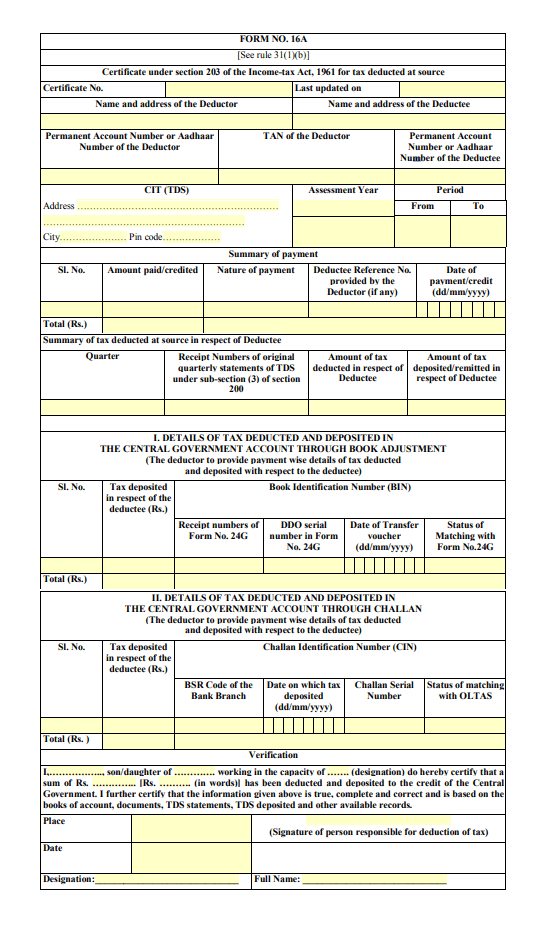

Form 16A Format

The notified format of Form 16 A can be downloaded here.

This form acutely shows details such as:

- TDS Certificate Number

- Name, address, PAN, AADHAAR, TAN of the deductor

- Name, address, PAN, AADHAAR of the deductee

- Relevant assessment year and the period for which the form is issued. This certificate is usually issued quarterly by the 15th of the month following the due date for filing TDS returns

- Summary of Payment (Income details)

- Summary of Tax Deducted at Source (TDS details)

- Details of Tax deducted and deposited with Central Government through book adjustment/challan

Notes:

- Government deductors need to fill the details under ‘ DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT’ if tax is paid without producing an income-tax challan. In case tax is paid after producing an income-tax challan the details need to be furnished under ‘DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN’.

- However, non-Government deductors should fill information only under ‘DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN’.

- The deductor must mention the address of the Commissioner of Income-tax (TDS) based on the jurisdiction of the assessee.

- While declaring the total amount of TDS deducted under ‘Tax deposited in respect of the deductee’, the deductor should also mention the amount of surcharge and education cess (if applicable) added.

Why is Form 16A required?

Form 16A is required at the time of filing the income tax return. This helps the filer to verify the income earned and TDS deducted. All details that are available in Form 16A are also available in Form 26AS. Further, this TDS can be used to set-off the tax payable (if any) or a refund can be claimed*. Moreover, some banks and financial institutions use Form 16A to verify the details of the applicant for processing loan applications. *Subject to conditions

Difference Between Form 16 and Form 16A

| S.No | Form 16 | Form 16A |

| 1. | Form 16 is the certificate issued by an employer to his/her employee stating how much tax was deducted at the source on the salary paid. | Form 16A is to certify the TDS amount deducted when the individual earns any income from sources other than salary. |

| 2. | Form 16 is issued when the total income of an employee exceeds INR 2,50,000. | Form 16A is issued when income from other sources exceeds the prescribed limits and TDS is deducted.* *Various sections under the Income Tax Act have defined the limits for deduction of TDS. |

| 3. | The TDS will be deducted based on the income tax slab, applicable to the employee. | In Form 16A, TDS is deducted on income from other sources based on pre-defined TDS rates. |

| 4. | Form 16 is issued annually. | Form 16A is issued quarterly. |

Need of GST In India | 16 Digit Invoice Number in GST | GST Inspector Salary | Dry Fruits Hsn Code | GST Maintenance Charges

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement