Masters India autoTax 365 and NAV 2016 (MSFT) - E-Invoicing Solution

MSFT - E-Invoicing Solution

Masters India understands that the taxpayers are hands-on with the ERPs they currently use. As of today, most of the ERP solutions do not have an integrated and holistic function to cater to e-Invoicing needs and nor can they connect with the Government Portals in real-time. While implementing a new process like E-Invoicing through the existing ERP, a right plug-in becomes necessary. To make lives more straightforward for taxpayers using Microsoft’s ERP - NAV 2016, Masters India has developed a solution called autoTax 365. In this article, you will be able to understand:

What is autoTax 365?

autoTax 365 is a power-packed package that will be available within NAV 2016. This is built to provide simplified GST compliance solutions. From GST filing to reconciliations, the user is covered. In-built features let the users generate E-Way Bills and E-Invoices too. Credit allocation, analytics and much more are possible with this software.

Why autoTax 365?

autoTax 365 is a cloud-based service that will enable NAV 2016 users to:

- Print error-free E-Invoices with minimum human interface

- File GST returns with data populated from the invoices and other inputs

- Avail maximum possible Input Tax Credit (ITC)

- Minimise errors/misses in the process

- Have lesser dependency on post mortem assessments

- Provide regular reports rather than a monthly one

- View dashboards and get notifications/alerts on time to ensure up-to-date compliance

- Get higher internal productivity and

- Have a seamless transition between different versions of NAV*.

*Currently, NAV 2016 is the ERP version that is in use. However, over time, upgrades are expected. D365 Finance and Business Central (as an extension on ‘App Source’, based on the new tax engine) are in the pipeline.

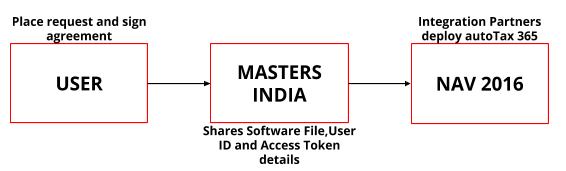

How does autoTax 365 work with NAV 2016?

We assure you that the users will be able to perform the complete process online and on a real-time basis. The downloadable E-Invoice will rest in your ERP for future use.

- Our integration experts will assist you in deploying the autoTax 365 extension onto your ERP (NAV 2016). In case your NAV license is due for renewal, the teams will help you in upgrading the same with the benefits of autoTax 365.

This file will be installed as an extension and will work as an upgrade to the existing NAV 2016 ERP. Once the installation is complete, the required fields and features will automatically be available through the ‘Home’ screen of the ERP. Be assured; there will be minimal changes in the current process.

- As part of the on-boarding process, our experts will share the list of validations and master data fields that need to be maintained. This will be in-line with the e-Invoice schema released by the Government. As a user, all you have to do is ensure that these details are handy and are filled in correctly while creating invoices. Example: HSN/SAC Code, State Code, Tax Amount etc.

- For any clarifications, concerns and support, Masters India has an SLA to provide round the clock services.

However, since autoTax 365 aims to be user friendly, we believe that the users will be able to use the ERP seamlessly with no direct interactions with Masters India GSP. The APIs successfully installed will do the talking on behalf of the user in the back end.

The process will simply be:

Masters India APIs will work as an intermediary between the ERP and Government portal.

- Changes in law/rules are expected from time to time from the Government. Regular API updates will be pushed to accommodate these required revisions.

- ERP version upgrades will not impact the functioning of autoTax 365.

E-Invoicing in NAV 2016 through autoTax API - Initial set-up

Once the API has been deployed, as a one time procedure, the first time user will have to make a few changes (through the Integrations Partner) in the ERP for setting up the process.

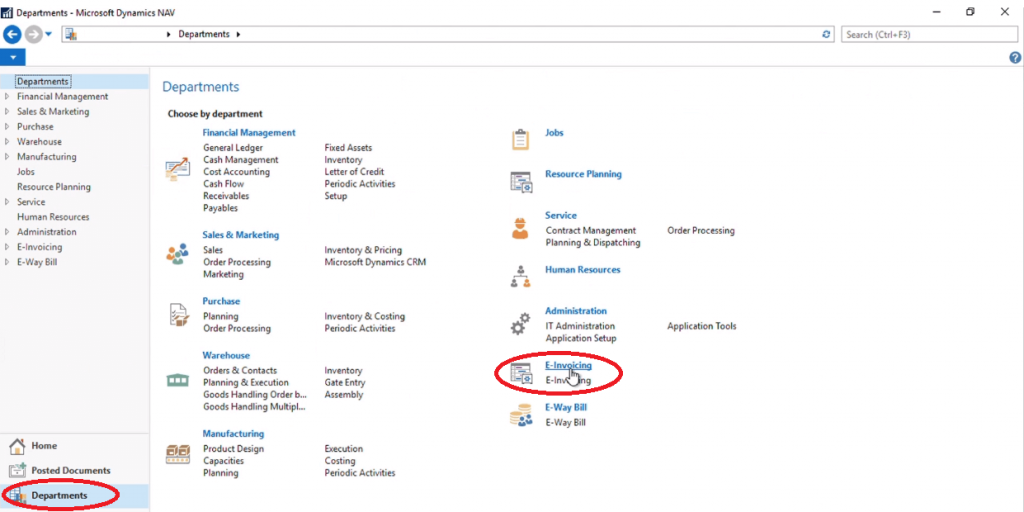

Step 1: Through the ‘Departments’ tab in NAV 2016, users will have to set up the e-Invoicing process.

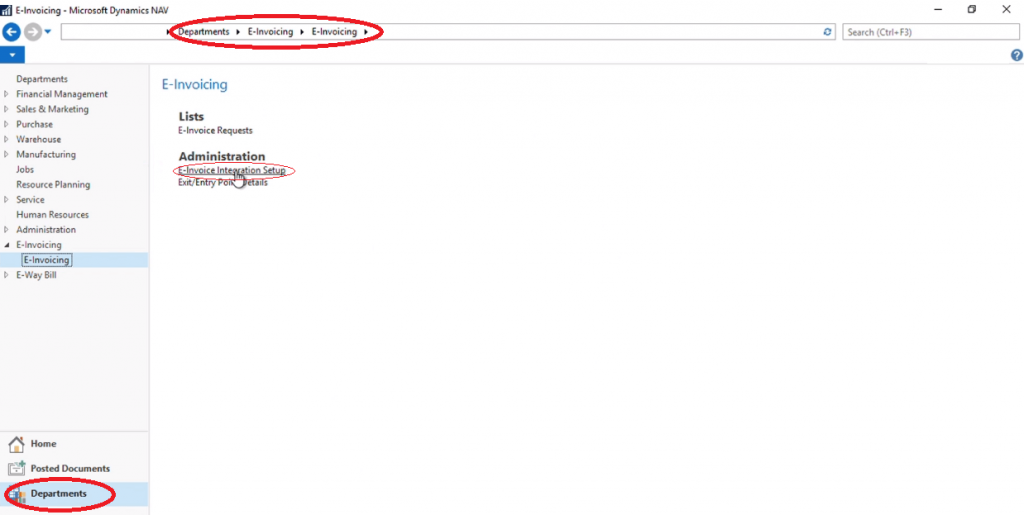

Step 2: Under ‘Administration’, select -’E-Invoice Integration Setup’.

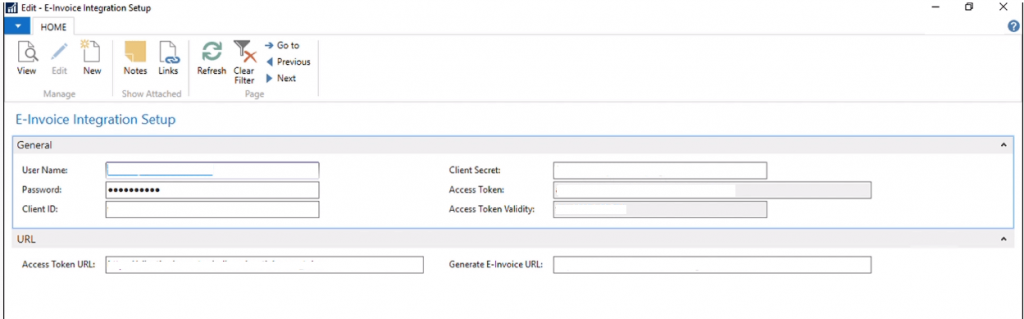

Step 3: Here, the user has to enter the ‘User ID’ and ‘Password’ used on the e-Invoicing portal. Masters India will share the other API related details like:

- Client ID

- Access token and related credentials and

- URLs’.

The Integrations Partners will do the needful here. Once these details are entered, the APIs will be called while validating the e-Invoices.

How to Generate an E-Invoice for a Sales Invoice?

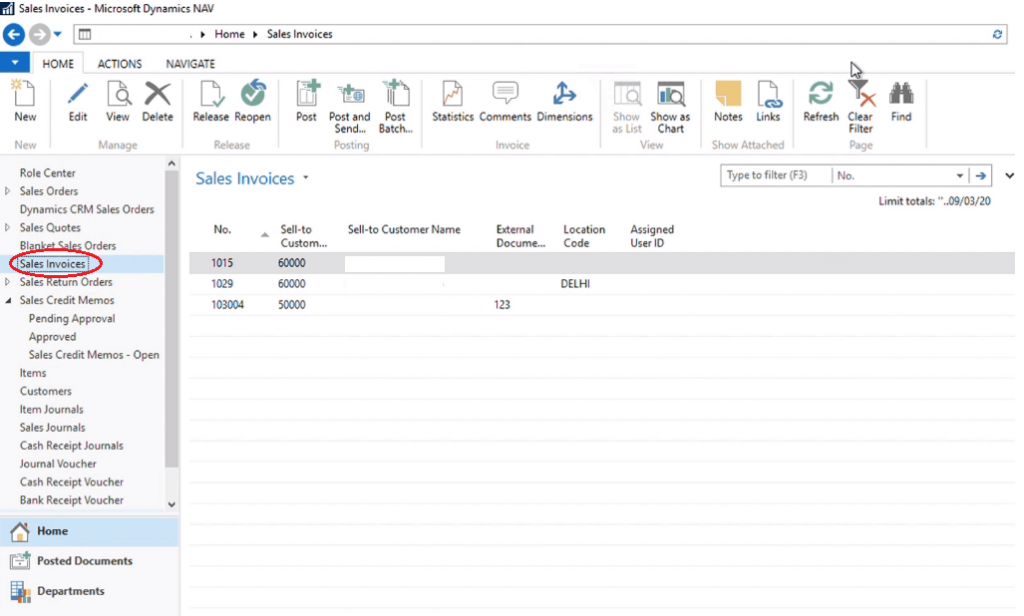

Step 1: Select the invoice to be posted.

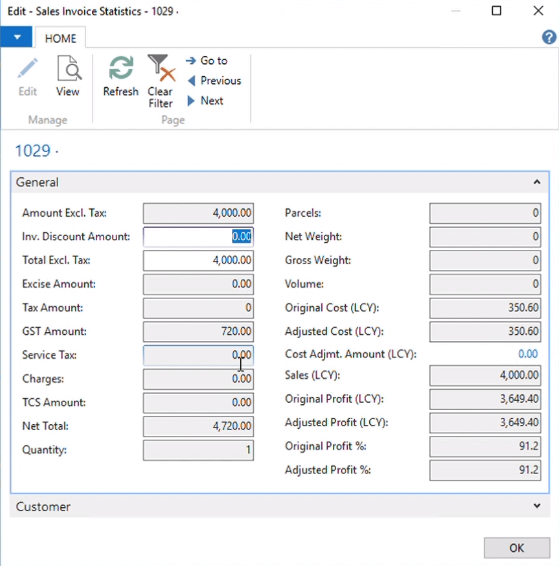

Step 2: Add and verify details. Most of the details here are auto-filled. However, essential pieces of information like ‘HSN/SAC code" and ‘Taxes’ need to be verified and entered (if necessary). In most of the cases, the taxes will be auto-calculated as a part of the base ERP functionality.

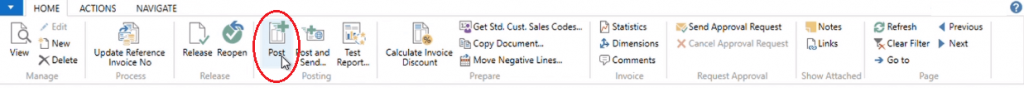

Step 3: Post the sales invoice.

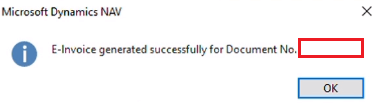

After the invoice is posted, the API will work at the back end, and once these details are successfully validated, the e-Invoice will be generated within seconds. A success message will be displayed communicating the same.

After the invoice is posted, the API will work at the back end, and once these details are successfully validated, the e-Invoice will be generated within seconds. A success message will be displayed communicating the same.

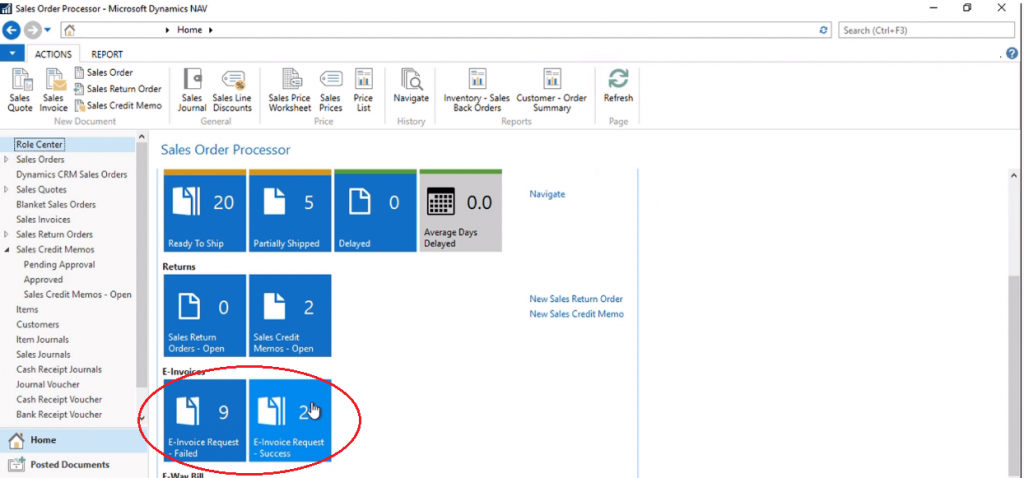

Step 4: View/Print e-Invoice. The NAV 2016 homepage has 2 data cues to view the details of E-Invoices generated and failed.

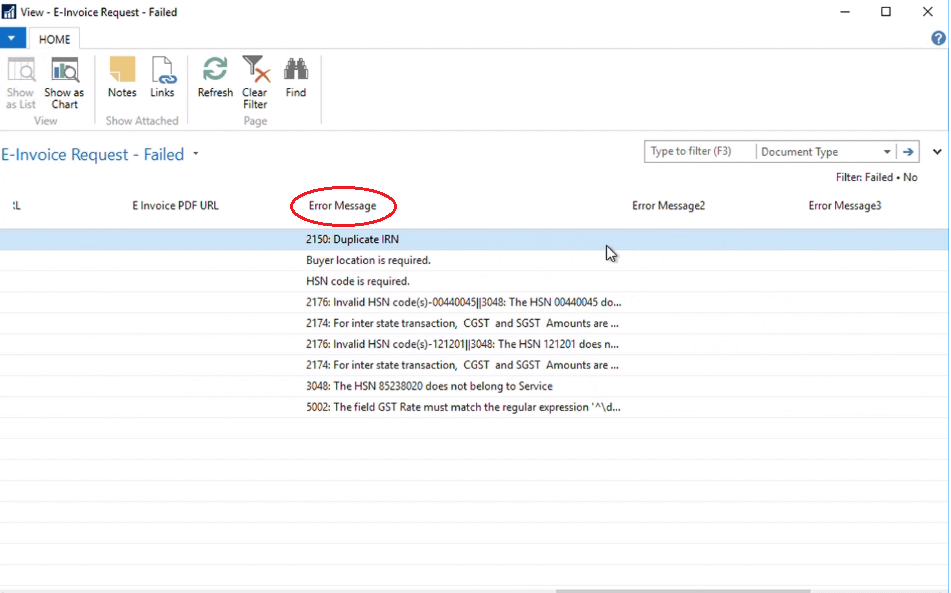

While working through NAV 2016, the users can not only view the details of e-Invoices not generated but also the reason for the failure. These error messages are retrieved directly from the Government website.

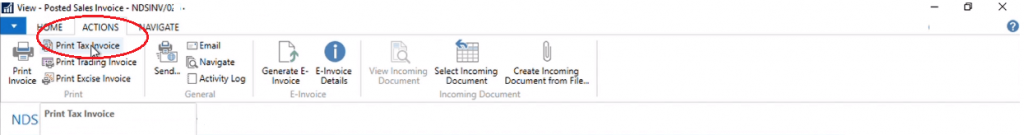

To print an e-invoice, the user can select the required invoice by clicking on the ‘E-Invoice Request - Success’ button. Here, the invoice details, including IRN and QR code, will be available. After this, under; Actions’, ‘Print Tax Invoice’ needs to be selected.

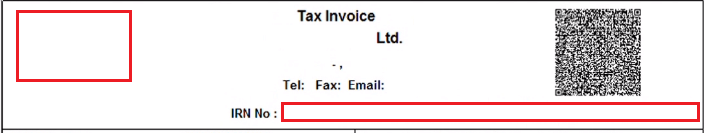

In a fraction of a second, the user will be able to print the e-Invoice. Company details, IRN and QR code will be visible upfront.

Please note: Users can create e-invoices from NAV 2016 based on the Sale Credit Memo and Transfer Statements as well. The steps remain the same. An audit trail showing the details of invoices generated with the time-stamp will also be available within the ERP. The process is as simple as it looks above. The frequently asked questions will be available soon for the benefit of our users. You can view the workflow of autoTax 356 in NAV 2016 here:

Privacy and Security

We understand that financial data is sensitive. To ensure that the user privacy is maintained and the data is secured, Masters India has taken cautious steps. Some of these are:

- The systems are annually audited as per the ISO 27001 guidelines.

- The data shared is encrypted throughout the process. That means the data is ciphered not only during the transition but also when it is at rest.

- We work on the Virtual Private Cloud at AWS.

- All the actions taken through autoTax 365 are ‘User Permission’ based.

Quick Recap - What is E-Invoicing?

The Central Board of Indirect Taxes and Customs (CBIC) has notified that from 1 October 2020, businesses with an annual turnover above INR 500 crores will have to ensure that the e-Invoicing process is implemented. The e-Invoicing process, in brief, is all about following a standardised protocol that will help taxpayers/users generate and read electronic invoices uniformly. With the implementation of this, the e-Invoice raised by a trader can be read by any computer system using a dynamic Quick Response (QR) code up or down the supply chain. The consumer too can integrate the data on their systems. We would re-iterate - The CBIC has clarified that ‘E-invoice does not mean the generation of invoices from a central portal of the tax department. Businesses will continue to generate e-Invoices on their internal systems – whether ERP or their accounting/billing systems or any other application. The e-Invoicing mechanism only specifies the invoice schema and standards to be inter-operable amongst all accounting/billing software and businesses.’ In case you need more information, please feel free to reach out to us on info@mastersindia.co.

Need of GST In India | 16 Digit Invoice Number in GST | GST Inspector Salary | Dry Fruits Hsn Code | GST Maintenance Charges

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement