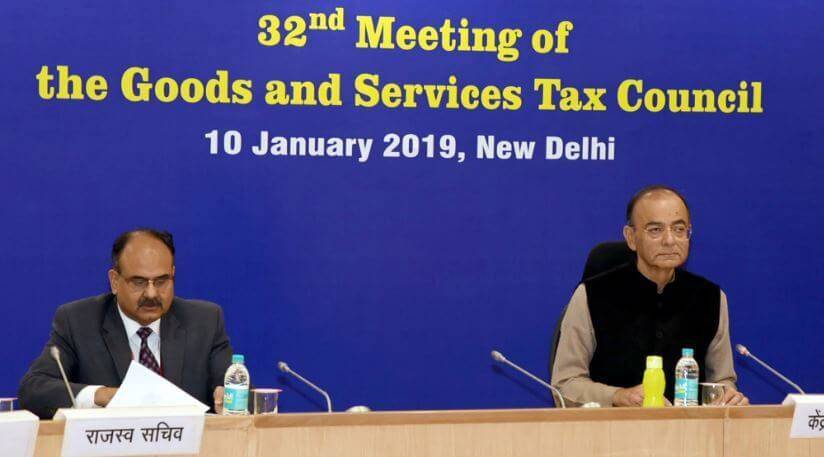

32nd GST Council Meeting

The 32nd GST Council Meeting was held today on 10th January, 2019 in New Delhi. This meeting was chaired by the Finance Minister of India, Arun Jaitley. Many decisions favorable to businesses were taken in the meeting. However, the key highlight of the meeting was increment in the tax exemption limit for businesses.

The tax exemption limit was relaxed by doubling it from Rs. 20 lakhs to Rs. 40 lakhs in the 32nd GST Council Meeting. The Finance Minister also said that the tax exemption limit for small states has also been doubled from Rs. 10 lakhs to Rs. 20 lakhs for businesses. The tax exemption threshold limit for MSMEs has been increased to Rs. 40 lakhs.

This threshold limit is for the annual turnover of those companies which are mandatorily required to register under GST. A dual threshold system is maintained with respect to the exemption limit. The North-Eastern and hilly states enjoy a lower threshold for coming under the special category, whereas the rest of the states are given a higher threshold for the exemption limit.

Arun Jaitley was quoted as saying, "The states will have the discretion to opt up or opt down the exemption limit. They will have to inform the Secretariat within a week if they wish changes in their exemption limit”.

The GST Council declared in the meeting that the composition scheme under GST will be extended to traders from the informal sector that provide services or mixed supplies with an annual turnover of up to Rs. 50 lakhs. Jaitley said that the rate for the composition scheme for these service providers will be charged at 6%, which is lower than the service tax they pay. The composition scheme turnover threshold has been increased from Rs. 1crore to Rs. 1.5 crore. Also, the composition taxpayers will be permitted to pay GST quarterly and file returns annually.

The panel also decided to allow Kerala to impose a cess so as to cope with the losses it faced due to the natural calamities last year. Crores worth of property was left damaged last year as the state saw one of its worst floods in years. By permitting a levy of cess to Kerala, the damage can be repaired to a great extent. Jaitley pointed out that such a provision exists in the GST Act for helping any state to cope with natural calamities by imposing cess on supplies. The Council has permitted a cess rate of 1% which Kerala can levy on intra-state sale of goods and services for not more than two years.

The GST Council had cut down slab rates of goods and services in its 31st Meeting on December 22nd, 2018, leaving only luxury and sin items in its highest (28%) slab rate of tax.

However, a revision of GST rates is yet to reach a consensus within the GST Council regarding the real estate sector. Currently, the properties for which completion certificate is not issued at the time of sale are levied at a GST rate of 12%. If completion certificate is issued for real estate at the time of sale, GST is not levied on its buyers.

Issues related to tax uniformity on lottery have also not yet been sorted. Two panels of ministers have been formed to look closer into these matters before being taken up by the GST Council again.

"A seven-member GoM has been formed to look into the GST on real estate. Another GoM with representation from lottery developing and selling states will be formed for uniformity of taxation on lottery or other issues arising out of lottery. These ministerial panels will give their recommendations in the next meeting”, Arun Jaitley said while addressing the press.

The decisions taken in the 32nd GST Council Meeting will be implemented from the beginning of Financial Year 2019, i.e. 1st April 2019.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement