What is Transporter ID in E Way Bill?

Transporter ID means is a Unique Identification Number that is of 15 digits and is allotted to an unregistered Transporter. This Transporter ID helps the transporter to generate e-Way Bills. Now the question to generate e-Way Bill? A transporter needs to generate an e-Way Bill either when the consignment value exceeds 50,000 INR or where the aggregate value of goods in a vehicle exceeds 50,000 INR. Since it is important for an unregistered transporter to generate e-Way Bill, the concept of Transport ID check was introduced by the Government of India.

Transporter ID Use Case

Whenever an unregistered transporter wants to move the consignment from one place to another he needs to mention the transport ID search in place of GSTIN. He just needs to provide this transporter ID either to the consignor or consignee as the case may be after with the help of the transporter id search facility. Now, let's know how to search transporter id check online.

How to Get a Transporter ID?

To get Transporter ID number verification, the transporter first needs to enroll himself/herself on the e-Way Bill portal. You can follow the below-mentioned procedure to check transporter id in e way bill.

- Step-1: Open the EWB Portal.

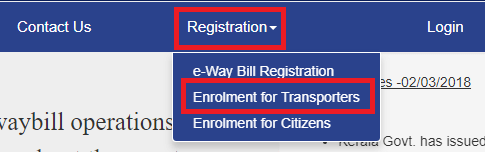

- Step-2: Click on the Registration button available on the top of the menu-bar and select Enrolment for transporters

- Step-3: After clicking on that option you will be redirected to a new page showing

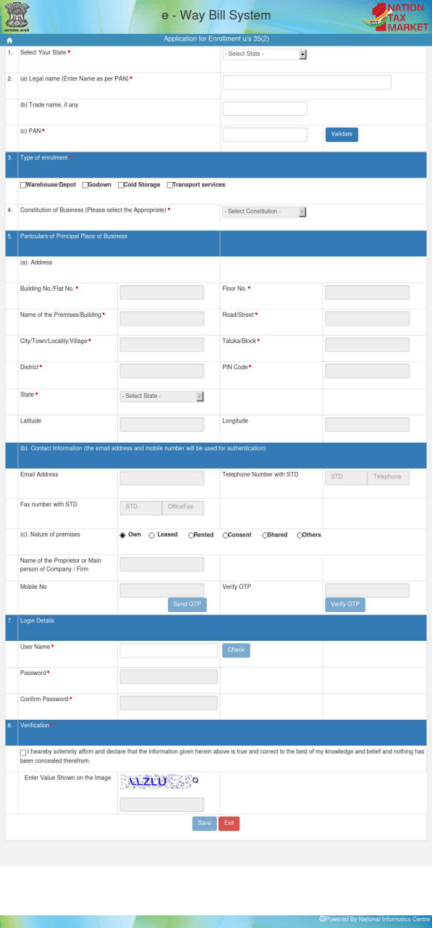

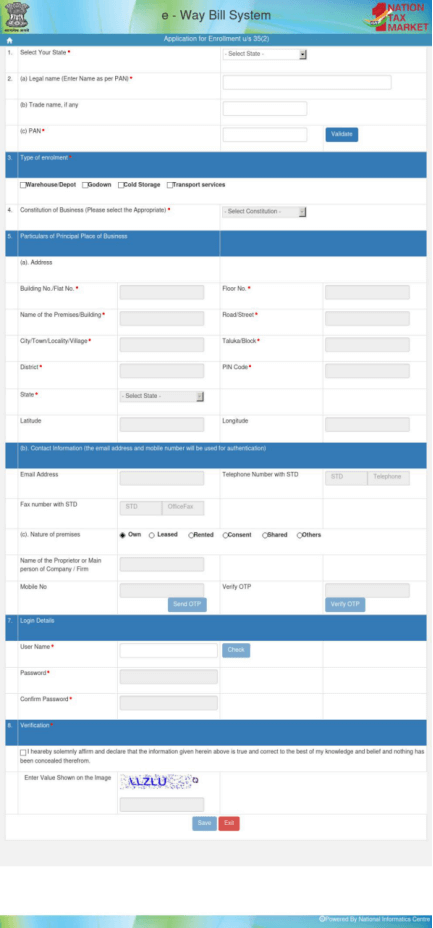

Parts of Enrollment Application Form

There are 8 parts of the application form that you need to furnish to enroll for the transporter ID:- In the first part of the enrollment form, you need to furnish the name of the state.

- This part contains three parts

-

- Legal Name as per PAN

- Trade name if any

- PAN* It shall be noted that your PAN is auto-validated once you enter it.

- The third part consists of the enrollment type. There are 4 different options that you can choose from Warehouse or Depot

-

- Godown

- Cold storage

- Transport service

- In the 4th part of the enrollment form, you need to choose the constitution of business. In other words, you need to mention the type of business that you want to enroll for the transporter ID like whether it is a:

-

- Foreign company;

- Partnership firm;

- Sole proprietor;

- Private Limited Company;

- Public Limited Company;

- LLP;

- Others (HUF, AOP, BOI and so on)

- In this part of the enrollment form, the transporter needs to mention three things

-

- the principal place of business

- Contact information

- Nature of premises whether it is owned, leased, rented, consent, shared or other.

- This part of the enrollment form is related to the login details where the transporter needs to enter a unique User ID along with a password. It shall be noted that the transporter can validate whether the User ID is taken or not by clicking on the Check Button.

- Once all the mandatory information is furnished by the transporter, he/she needs to verify the details mentioned by ticking on the check button. After verifying all the details the transporter will receive a 15 digit transporter ID. He/she shall convey the same to the consignor and consignee so that the transporter can edit the details in PART-B of e-Way Bill.

Format of Transporter ID in GST Enrollment Application Form

Here is the format of enrollment application form:

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement