ICEGATE shipping bill is the most important to get clearance from the customs authorities.

| What is a Shipping Bill? |

| Shipping Bill Types |

| Shipping Bill Format |

| What is the Process of Shipping Bill? |

| Shipping Bill Generation Procedure |

What is a Shipping Bill?

Shipping bill tracking is a type of bill which has to be mandatorily furnished by the exporter to get customs clearance. It shall be noted a person needs shipping bill to load the goods so it is important for the exporter to furnish the same. There are 3 ways through which one can export goods and they are:

- Land

- Sea

- Air

A person can only load goods if the following documents:

| Sea/Air | Shipping Bill (SB) |

| Land | Bill of Export (BOE) |

In the case of transhipment, the exporter needs to furnish the Bill of Transhipment (BOT). Shipping bill needs to be electronically submitted on the ICEGATE portal. However, the exporter can also submit a physical shipping bill but before doing this he needs to obtain prior approval from the Principal Commissioner or commissioner.

Shipping Bill Types

There are different types of shipping bill in export that can be differentiated based on colour. Here are the types of shipping bill and their denoted colours:

| S. No. | Name of the form | Colour |

|---|---|---|

| 1. | Goods on which customs duty is applicable | Yellow |

| 2. | Goods on which customs duty is not applicable | White |

| 3. | Goods with drawback claims | Green |

| 4. | Goods listed under DEPB Scheme | Blue |

| 5. | Goods allowed to be exported as duty-free ex-bond | Pink |

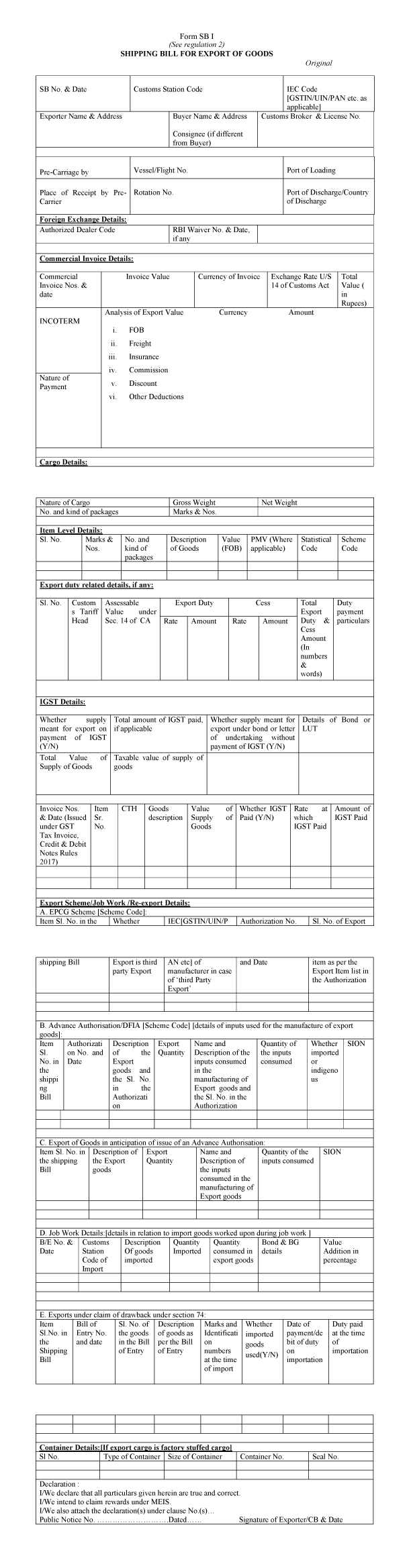

Shipping Bill Format

The prescribed format of shipping bill for export is:

What is the Process of Shipping Bill?

Once the vessel, ship etc receives the grants to move out of the country then at that point of time shipping bill needs to be furnished. After the submission of the shipping bill, it is verified by the customs authorities physically and the value of goods is assessed. After verifying it the customs authorities endorse the copy of this shipping bill with let export order and let ship order.

Shipping Bill Generation Procedure

Here are the procedural steps to generate Shipping Bill:

i. The exporter needs to have the following things in hands at the time of generating shipping bill number format :

- IEC Code No. or Customs House Agents (CHA) license number

- Authorized Dealer Code bank number using which the export proceeds will be initiated

ii. Declaration signed either by the exporter or his customs house agents together with the invoice and the packing list copy which have to be submitted at the service centre.

iii. After the completion of the data entry, the exporter needs to validate the data using the checklist and will have to inform the same to the service centre. In case if the data is correct, the data get automatically processed.

iv. The Assistant Commissioner of export assesses the processed data in case

- If the value of such export is more than 10 Lakhs INR, or

- If the value of free samples is more than 20,000 INR or

- Where the drawback amount exceeds 1 lakh INR

v. Status of the shipping bill can be checked by the exporter through service, after the completion of the above procedure.

vi. In case if there is any query raised the exporter will have to furnish his reply to the service centre as soon as he received the query.

vii. Before exporting the goods the exporter needs to submit all the original documents such as invoice, packing list etc. together with a checklist.

viii. If the exporters receive ‘Let Export Order', the exporter can generate the shipping bill

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement