Application Reference Number (ARN) helps the applicant to track the GST registration status till the time he/she gets the GST Registration Certificate and GSTIN. Let us understand the different steps involved in tracking the GST registration status using ARN or GST ARN status check through this article.

The scope of this content includes:

1. What is ARN?

ARN Full Form is Application Reference Number that is a unique alphanumeric code that gets automatically generated when the applicant applies for the GST Registration. ARN helps the applicant to track the status of their GST Registration application form and identify whether GST status or GST application status is rejected or accepted by the GST authorities while doing GST tracking.

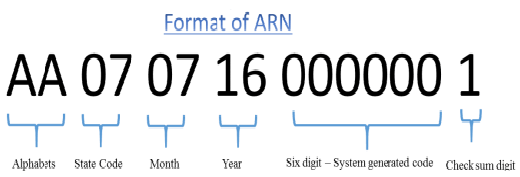

2. Format of ARN

ARN number format or ARN Number is a 15 digit alpha-numeric code, where.

- First, 2 codes are alphabets

- Next 2 digits represent the state code

- Subsequent 4 codes indicate Month and Year

- Following 6 digits are the unique system generated number and

- Last code shows checksum digit

Let us understand the format of the ARN code with an ARN number example and about ARN status gst:

3. How to Track GST ARN Status?

Once the applicant receives the GST ARN, the status of GST Registration can be tracked using the GST ARN on the GST Portal. For ARN number tracking and ARN status check the applicant needs to follow the below mentioned steps:

Step 1 – Visit the GST Portal using the following link https://www.gst.gov.in/

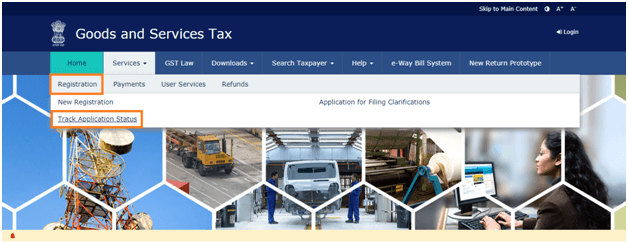

Step 2 – Then go to Services Go and Choose Registration option from the drop-down menu.

Step 3 – Once you choose the Registration option from the drop-down menu, click on the Track Application Status.

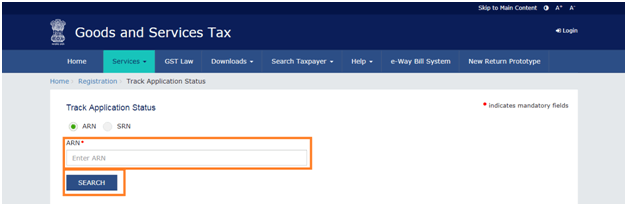

Step 4 – After clicking on Track Application Status you will be redirected to a new page, wherein, you need to enter the Application Reference Number (ARN). After doing so you need to click on the SEARCH button to track the status of ARN.

4. GST ARN Track Status

There can be 6 different outcomes for ARN tracking when an applicant track the ARN Status and they are:

- Form Assigned to GST Officer

This ARN Status appears at the time when the GST application is assigned to the GST officer for processing and approvals. It shall be kept in mind that this status does not imply that your GST Registration application has been cancelled.

- Pending for Clarification

The above-mentioned ARN status comes when the GST officer requests the applicant to submit the clarification on the filed GST Registration application. And in this case, the applicant shall submit the clarification on the GST Portal as soon as possible.

- Clarification Filed – Pending for Order

This status appears when the clarification is filed by the applicant against the concerns escalated by the GST Officer. Howsoever, the order for approval is still on hold form the GST officer side.

- Clarification not Filed – Pending for Order

This ARN status appears when the applicant does not provide the clarification to the GST officer within the prescribed time period. And there is a high probability that the applicant’s GST registration application will get rejected by the concerned GST officer.

- Application Approved

If the applicant gets this status after tracking the status then this means that the application for GST registration has been approved by the GST Officer. Once this status appears then the applicant will soon get GST identification number (GSTIN) along with GST registration certificated shortly.

- Application Rejected

This ARN status appears when the GST Registration application is rejected by the GST officer. Moreover, if the applicant wants to register under GST, he/she needs to re-submit the GST Registration form.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement