The Government recently announced that the generation of E-Way Bills (EWB) would be blocked for taxpayers who have defaulted in filing 2 or more GSTR-3B returns, up to the tax period of August 2020 (September 2020 return). Currently, this applies to taxpayers having PAN level, Annual Aggregate Turnover (ATTA) more than INR 5 crores. In this article, we will help you understand:

What Is Blocking And Unblocking Of The E-Waybill Generation System?

Blocking of EWB generation: If a taxpayer having ATTO (at PAN level) more than INR 5 crores, does not file his/her GST returns for two successive months or quarters, the certified authorities will block the GSTIN from generating EWay bill Unblocking of EWB generation: Once the GSTIN holder files the pending returns, the certified authorities will unblock the EWB generation system for the taxpayer (GSTIN holder).

| Check GST Block/Unblock Status of GSTIN Here |

How To Unblock The E-Way Bill Generation System?

If the blocked taxpayer (GST block status) has filed the required returns (GSTR-3B) on the GST Common Portal, then, on the next day (morning) his/her GSTIN will be automatically unblocked on the e-way Bill system, and he/she will be able to generate e-Way Bills. However, If the taxpayer wants to generate e-Way bills immediately after filing the pending returns, then, he/she can:

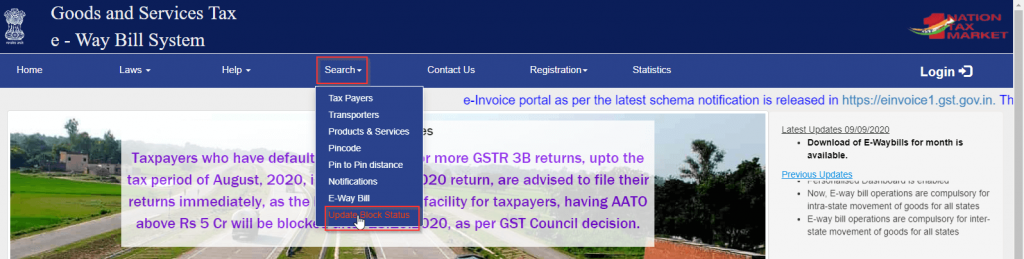

- Visit the e-Waybill portal and under ‘Search’ select ‘Update Block Status ‘.

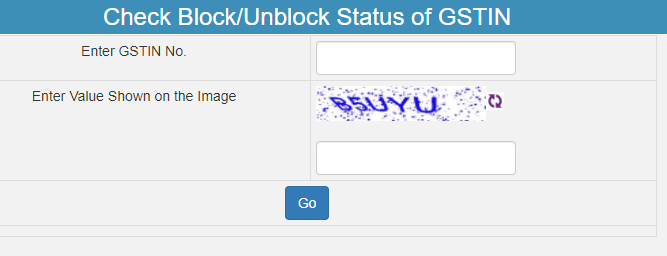

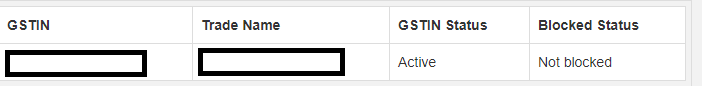

- Here, the taxpayer can enter the relevant (check GST block/unblock status of GSTIN) GSTIN and check the status of the GSTIN.

Result:

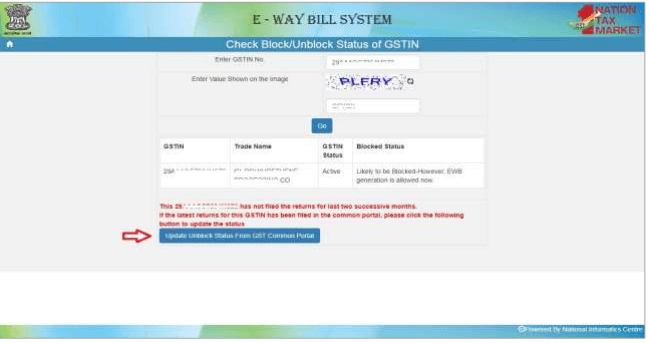

Result:

- In case the EWB system is blocked, he/she can use the ‘Update’ option to get the latest filing GST block unblock status from the Common Portal and unblock the system.

Image Source: https://docs.ewaybillgst.gov.in/Documents/Unblockver1.pdf

- If the system does not get unblocked, the taxpayer can contact the ‘Help Desk’ of the GSTN and raise a complaint to get the matter resolved.

Points To Remember

- The EWBs generated before the system was blocked, will not be affected by the blocking/unblocking process. That means, the e-Way Bills already issued will remain valid and the goods attached to these EWBs can be moved to the destination without any problem. Furthermore, for these e-Waybills, transporters/taxpayers, including blocked GSTIN holders, can update the vehicle and transporter details (Part B) and carry out the extension, if required as well.

- If the GSTIN of a supplier or recipient is blocked for e-Waybill generation, then neither the supplier nor recipient can generate E-waybill on behalf of the blocked counterpart.

- If the GSTIN of the supplier or recipient is blocked due to non-filing of returns, the transporter cannot generate the e-way bills on their behalf.

Need for GST In India | GST Invoice Serial Number Rules | Powers of GST Officers | Dry Fruits GST Rate | Maintenance Charges GST

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement