Link E-Way Bill To VAHAN Portal

The VAHAN System provides a digitised database of registered vehicles in India. This system helps users to know vehicle details online, thus eliminating the possibility of fraud and errors. To help taxpayers, the e-Way Bill system has been integrated with the Vahan services of the Transport Department. An e way bill search by vehicle number is also possible. The vehicle number entered in any E-way bill can now be verified with the Vahan portal system immediately. Once the vehicle details are updated in the Vahan system, the status in the e-Waybill system will subsequently get updated and you can find all about E way bill. In this article, we will discuss how to make e way bill with the temporary number and answer the following:

What Is Vahan System?

VAHAN, under the Ministry of Road Transport and Highways, is a comprehensive system that takes care of all the burdensome activities of Vehicle Registration. For GST registered taxpayers generating EWBs, this system provides a nationwide search over the digitised data of registered vehicles. Taxpayers can view the details of registered vehicles online based on certain parameters like:

- Registration number

- Chassis number

- Engine number

This works as a centralised directory for information about registered vehicles in India.

Vahan And E-Way Bills - How Will The Integration Work?

Let's know how to check e way bill by vehicle number? The e-Way Bill (EWB) portal and the e vahan system are linked to verify/confirm the validity/existence/correctness of the vehicle and check e way bill by vehicle number. While generating an e-Way Bill, the taxpayer is required to enter the vehicle number. When this vehicle number is added, the EWB system will immediately verify the details of the vehicle from the Vahan system in the backend in real time. In case the vehicle number is invalid/not registered with the system, the EWB will not be generated, and the taxpayer will be alerted to check and correct if required. Furthermore, the EWB portal will alert the taxpayer in case there are any other discrepancies. The most common alerts are about:

● Non-availability of vehicle number

When a vehicle number is not registered/listed in the Evahaan system, the taxpayer is alerted that such a vehicle number is unavailable in the records. Though this number will be allowed initially on the EWB portal, subsequently taxpayers will not be able to use it. This error can be fixed by completing the vehicle registration process with the concerned Regional Transport Office (RTO).

● Vehicle registered in more than one RTO

When a vehicle number is registered/listed in multiple RTOs’, the taxpayer is alerted. Though this number will be allowed initially on the EWB portal, subsequently taxpayers will not be able to use it. This error can be fixed by updating the vehicle registration details in the correct Regional Transport Office (RTO). Once the vehicle details are updated in the Vahan system, the status in the e-Waybill system will subsequently get updated.

● Temporary Registration

Here, we learn how to generate e way bill with a temporary number. In case a taxpayer is transporting goods through a vehicle with temporary registration, the EWB portal will not verify the details of the vehicle. In this case, the taxpayer generating the EWB should enter the e way bill temporary vehicle number starting with TR.

● Details available in Vahan system but not on EWB portal

If the vehicle number is available on the Vahan system but is shown as ‘Not available’ on the EWB portal, the taxpayer can contact the E-way bill helpdesk and submit his/her grievance by specifying the Vehicle number.

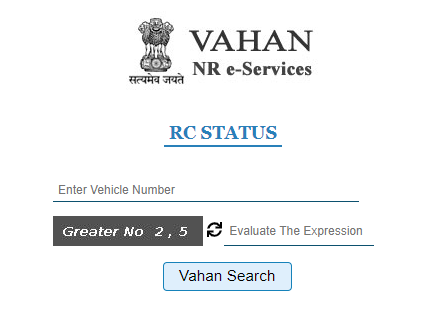

How To Check Vehicle Registration Status?

Before adding the vehicle details in the EWB, the vehicle details can be verified vahan track here.

In this way, you can get the vehicle registration status and also understand how to enter the temporary number in e way bill.

Need of GST Notes | GST Invoice Number Length | Power of Officer Under GST | GST On Dry Fruits | GST On Society Maintenance

Frequently Asked Questions

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement