Table-6A in GSTR-1

Since the due dates for filing for GSTR-01 for August, September and October’17, have not been announced, there is a new functionality - Table 6A, being added in the Form GSTR 1 to enable the tax payers to file GSTR-1 and claim their refunds with ease.

The article aims to apprise you about everything you should know about the export without payment of tax in gstr-1.

The Table-6A looks like this:

- What is table-6A of GSTR-01?

- Who should file Table-6A?

- How can an exporter file a refund using Table-6A?

What is Table-6A of GSTR-01?

Table-6A is basically a facilitator and a mechanism to expedite the refunds for the exporters who missed out filing GSTR-01 for August, September and October in the absence of the due dates and so were deprived of claiming the refunds. An exporter is eligible to claim refunds only by filing the GSTR-01 with details of all exports for a month since GSTR-3B does not have invoice level data. Table 6A of GSTR-1 empowers the exporters to fill in all the details and head for a smooth and speedy returns. In this way, users can learn how to show export invoices in gstr 1.

Who should file Table-6A?

Table-6A basically applies to those exporters, who exported goods after the inception of GST from 1st of July’17 and missed on filing the GSTR-01 for August, September and October’17. Should an exporter has not carried out any export activity since then, he should not be bothered about this new inclusion. Also, there is no need to file a nil return. Exporters should know about wopay export type and other types.

How can an exporter file a refund using Table-6A?

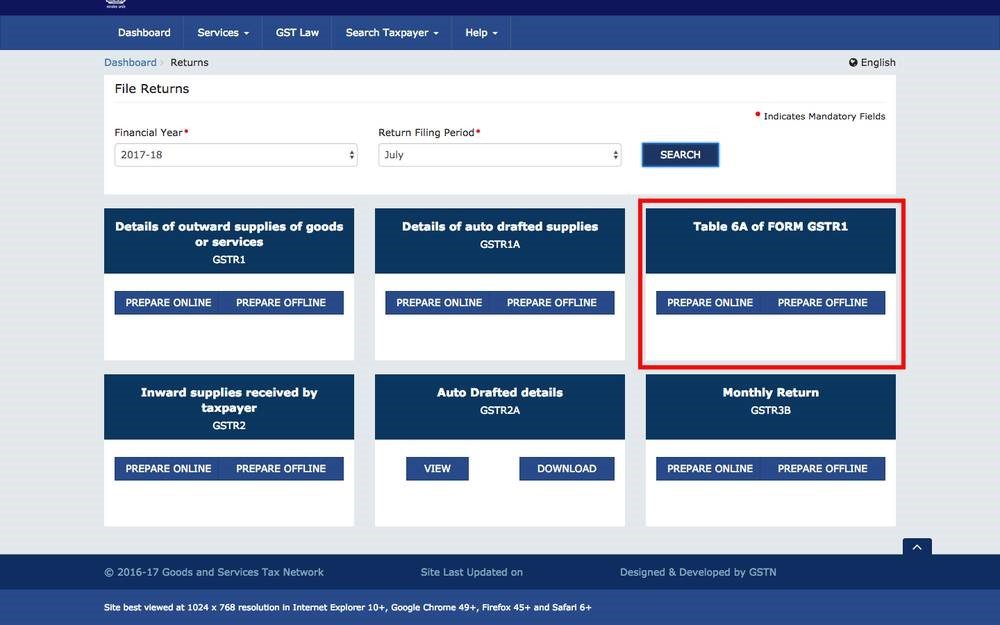

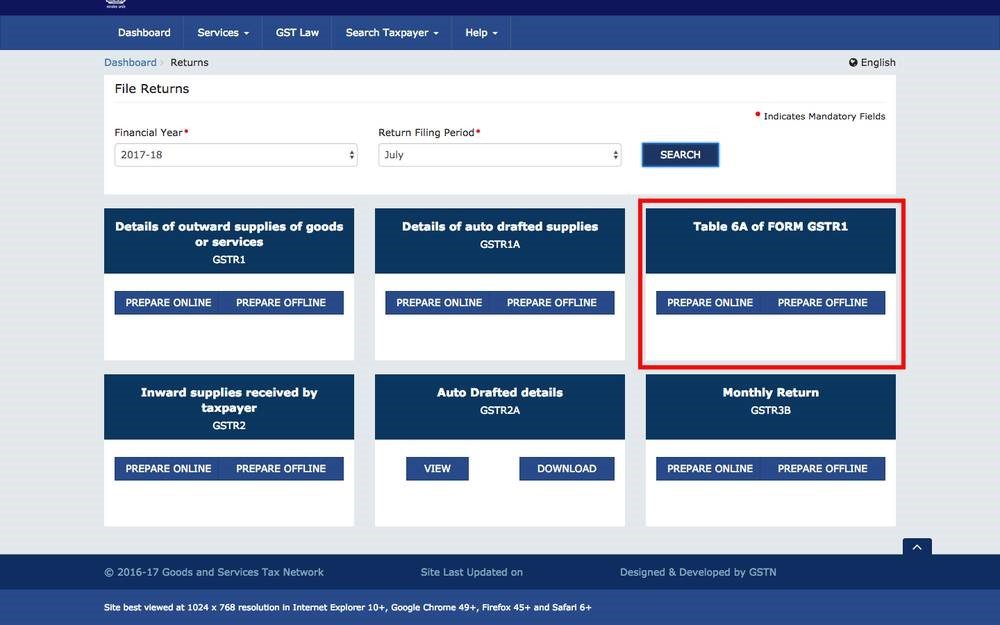

The below process explains the filling of the Table-6A in GSTR-01 step by step:

- Log in to the GST portal and go to the Returns tab

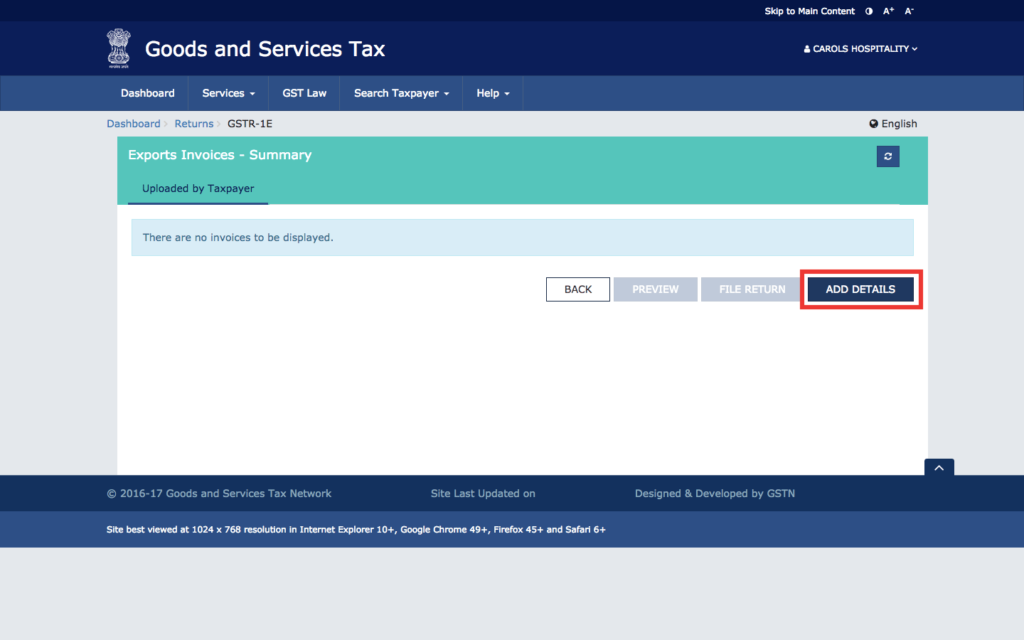

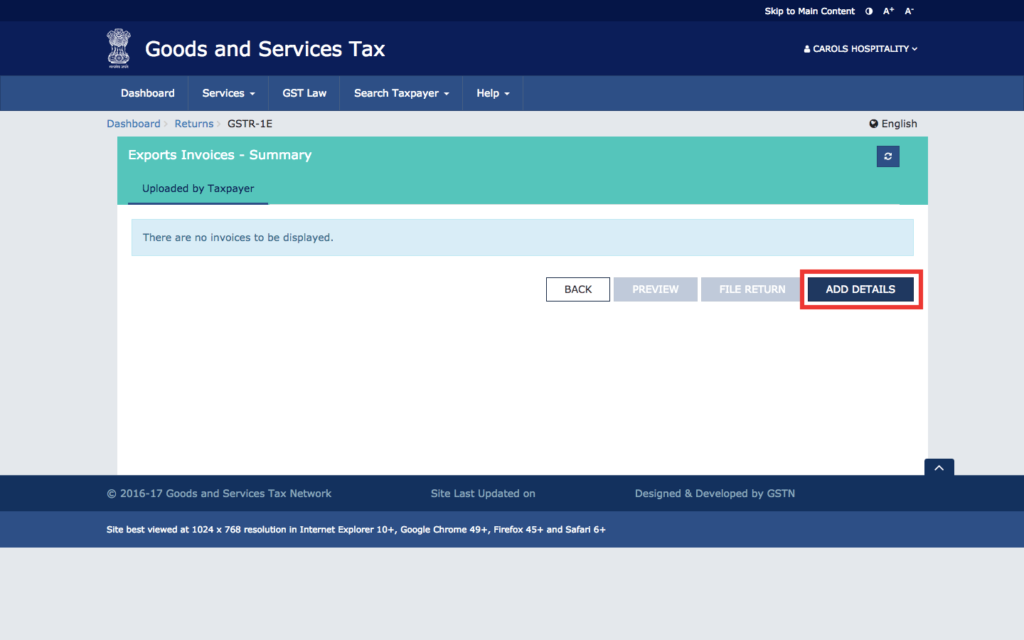

- Select Add Details – Click on Add Details to start entering the details of the export invoices.

- Fill in the details of the export invoices:

The column will need you to fill information pertaining to the invoice number, invoice date, port code, shipping bill number / bill of export number, total invoice value, supply type, amount of GST payment.

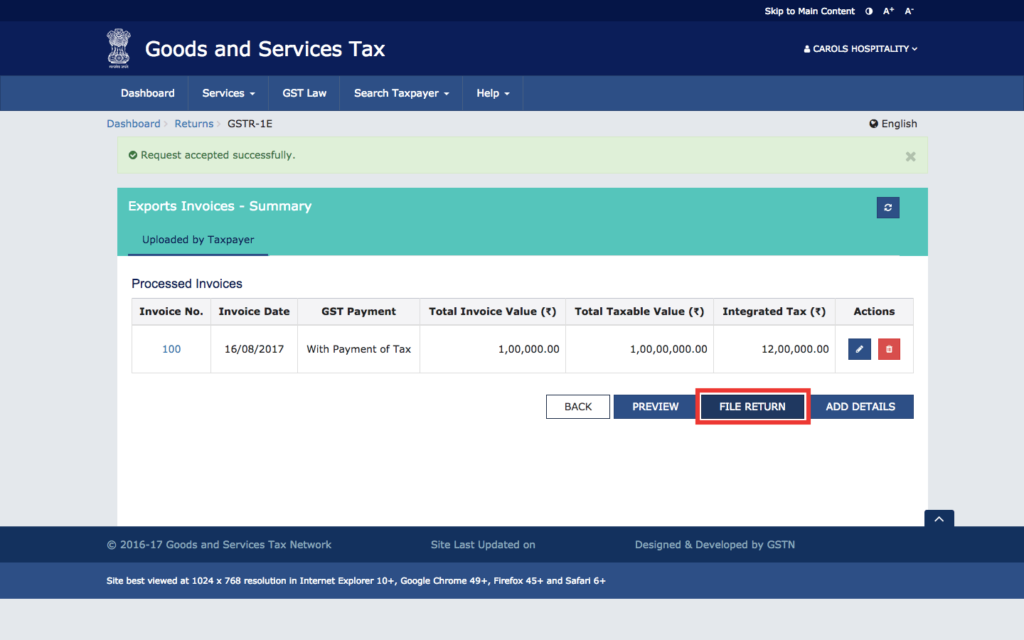

- File GSTR-1E return:

Click on File Return when the details of all the invoices in a month are entered and uploaded. Do ensure to upload each invoice before clicking the File Return because there is no provision of editing, once uploaded.

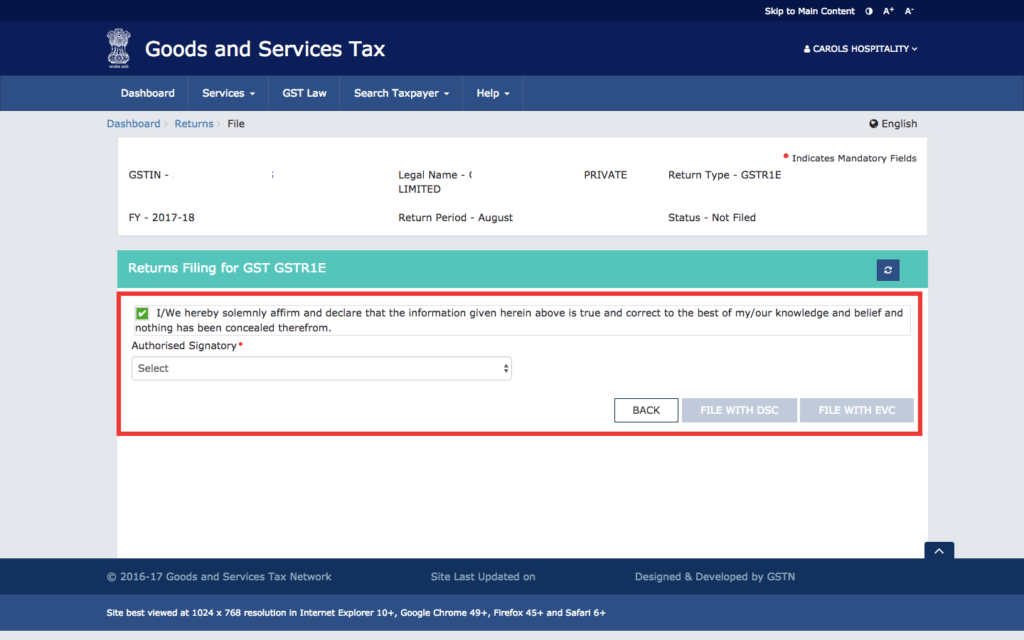

- Digitally sign it and submit:

The next page after clicking File Return will bring you to a drop down list where you have to select the authorized signatory and submit the return with a digital signature. GSTR-1E will not be submitted in the absence of a digital signature.

Should you still be confused about any intricacies involving Table-6A and want to consult an expert, the proficient team at Masters India, a GST Suvidha Provider is here to help. Exporters can resolve their issues like how to file gstr-1 for export invoice without payment of tax. The autoTax from Masters India, a GST Suvidha Provider is a fully automated GST software, which along with other numerous functionalities also ensures that you always stay on top of it and be in the good books of the government by maintaining a high GST compliance rating.

Click here for more articles on GST – deeply technical and news updates.

To explore, how can you put your taxation life cycle on an auto-pilot, please connect with Masters India at info@mastersindia.co | 18002126141.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement