Know How to File GSTR 3B

Every regular taxpayer registered under GST shall file the return in GSTR 3B. Using autoTax GST software one can easily file the GST Returns simply and quickly. The due date of GSTR 3B filing is the 20th day of each succeeding month. So as to avoid the consequences for not filing the GST Return one must opt the autoTax GST solution. Here, we will discuss gst 3b return, how to file gstr 3b, how to file 3b in gst portal, gstr3b means.

In this article, we will know how to file GSTR 3B in two simple ways.

1. Manual Mode: Where the taxpayer has to manually enter the data.

2. Auto Mode: Where the invoice data gets auto-populated in GSTR 3B.

Manual Mode

In case the taxpayer wants to manually enter the data in GSTR 3B, he/she can opt for manual mode and can easily prepare the GSTR 3B in no time. Let us see the steps involved in it.

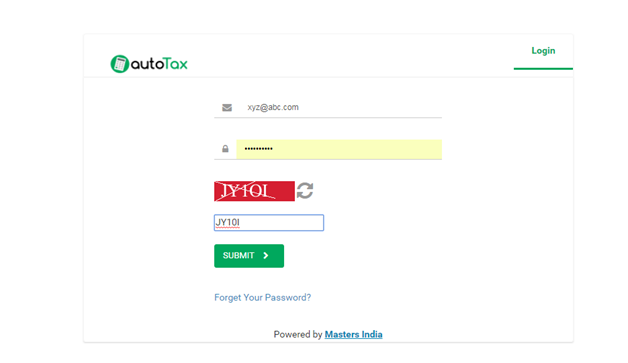

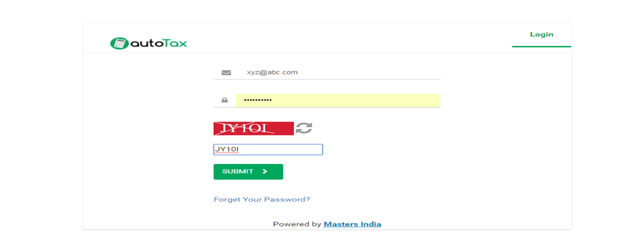

1. Login to autoTax account with valid credentials and by entering the captcha image.

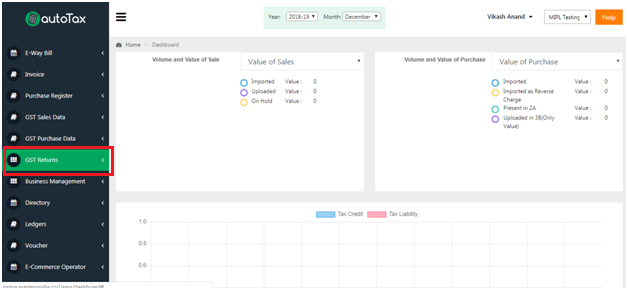

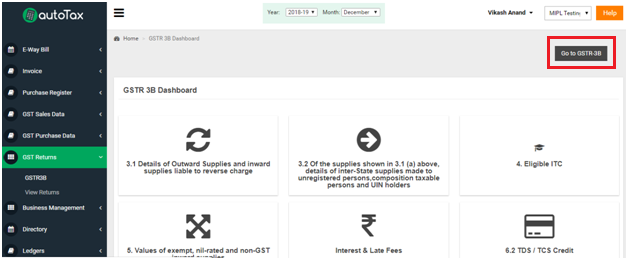

2. From the side menu select GST Returns option.

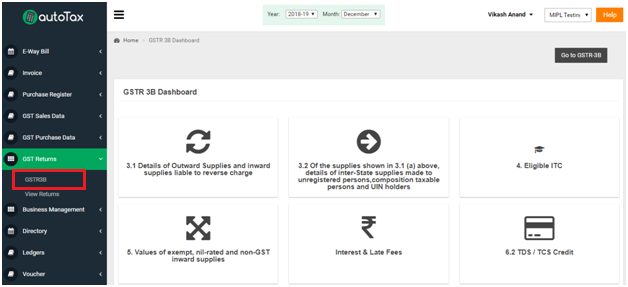

3. Then choose GSTR 3B from the dropdown list.

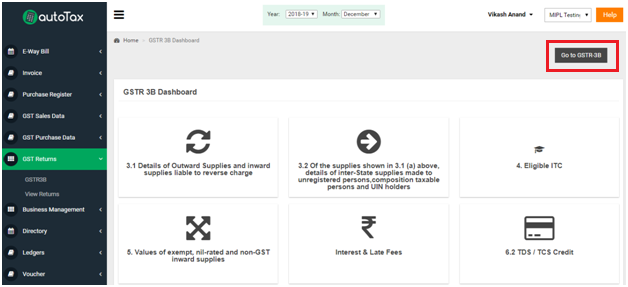

4. Select Go to GSTR-3B present in the top right corner.

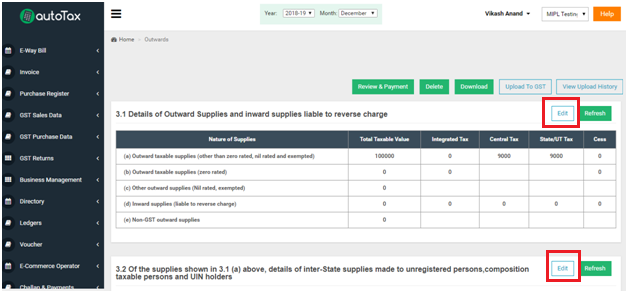

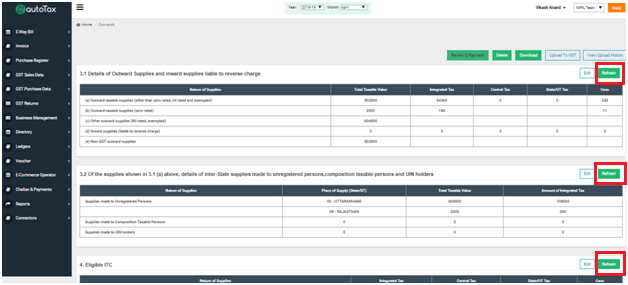

5. Then click EDIT option available on the tables present on the page one by one.

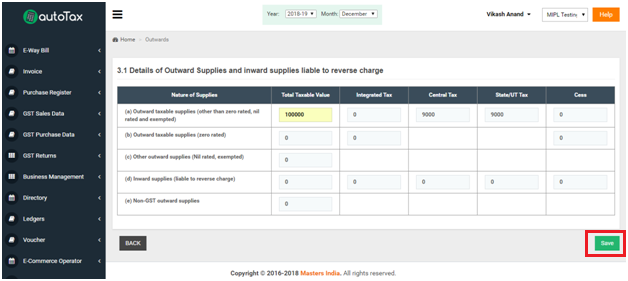

6. Afterwards, enter the data and then click SAVE.

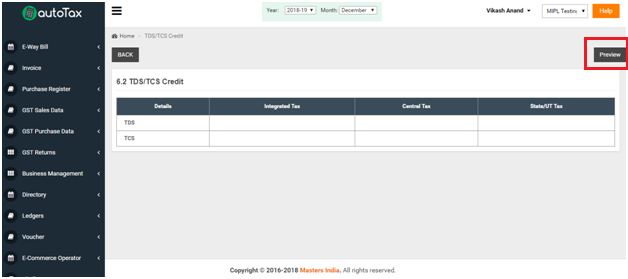

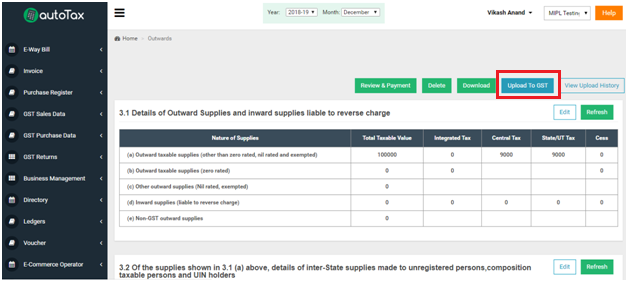

7. Then click continue and Select Preview.

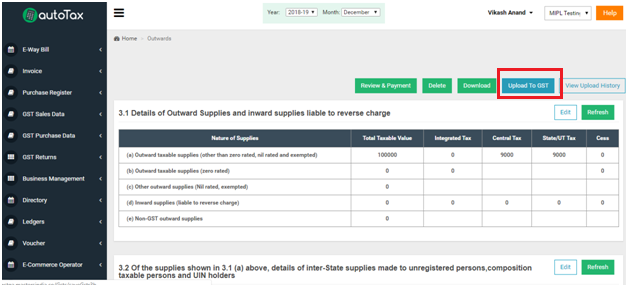

8. After previewing select Upload to GST.

After uploading the GSTR 3B on the GST portal the taxpayer has to pay the tax on the GST portal GSTR-3B.

Auto mode

Any taxpayer can quickly file their GSTR 3B using the auto mode that is available on the autoTax.

This feature can be easily used by the taxpayer by simply uploading the purchase and sales invoices through Government utility or invoices created by autoTax. Here is a quick guide for GSTR 3B filing using auto mode by autoTax

1. Login to autoTax with valid credentials.

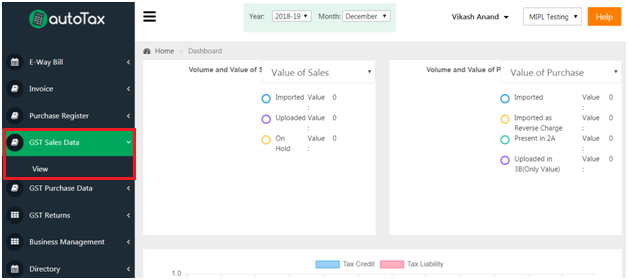

2. Select GST Sales Data from the sidebar and then click on view from the drop-down menu.

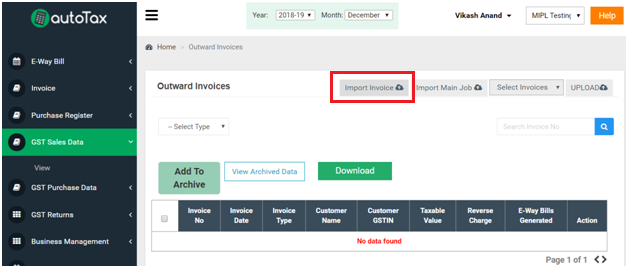

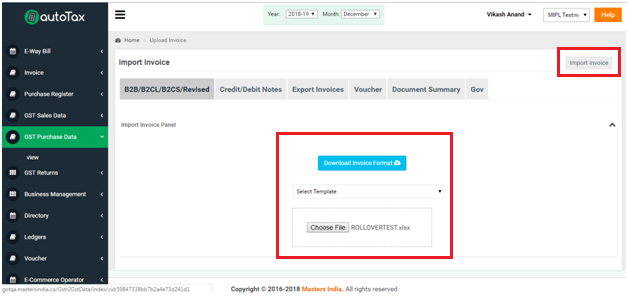

3. Select Import Invoices present.

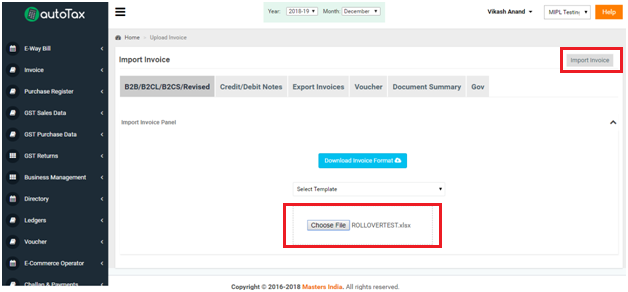

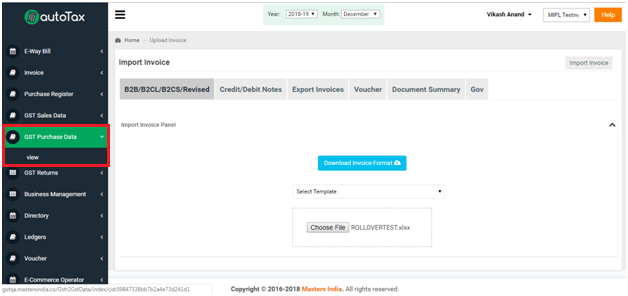

✩ Note the taxpayer can upload different types of invoices including

• B2B/B2CL/B2CS/Revised

• Credit/Debit Notes

• Export Invoices

• Voucher

• Document Summary

• Gov (Government utility)

4. Choose the file from your system and click on Import Invoices.

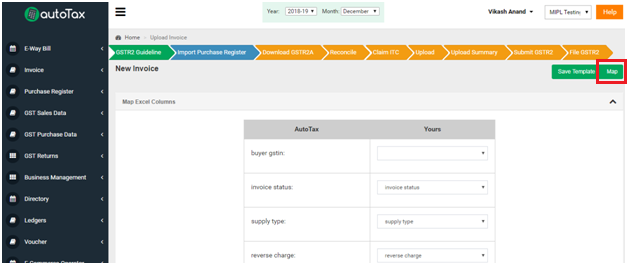

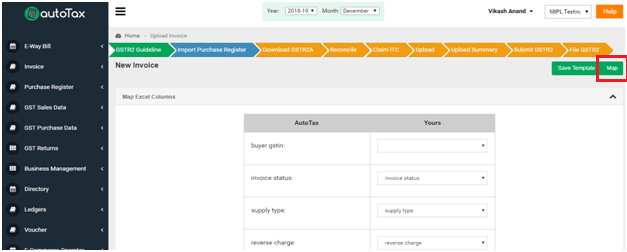

5. Then choose MAP option.

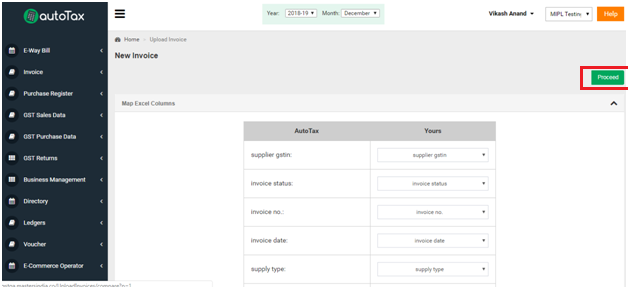

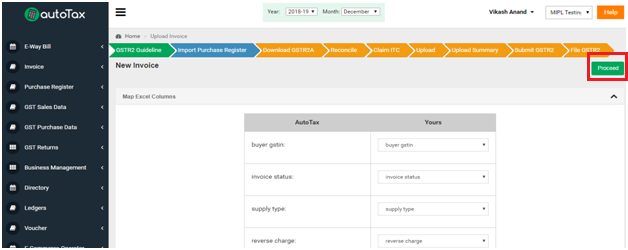

6. Afterwards, select Proceed.

7. Choose GST Purchase Data and click on View.

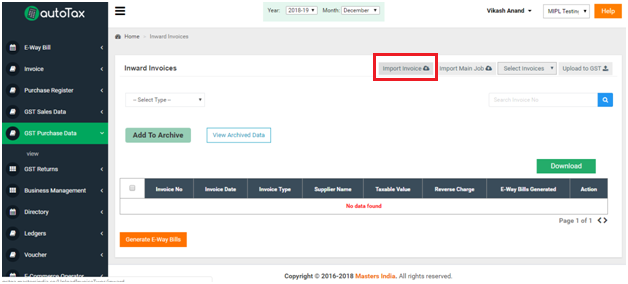

8. Select Import Invoice option.

9. Choose the invoice file from your system you want to upload and click Import Invoice.

Your invoices will be imported.

10. Select MAP option that is present on the top right corner.

11. Select Proceed.

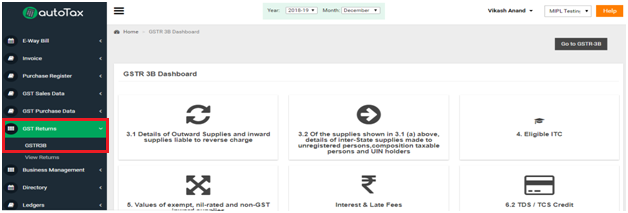

12. Go to GST Returns and select GSTR 3B

13. Choose the option Go To GSTR 3B from the right corner.

14. Refresh all the columns present which will auto-populate all the fields present in the column using the sales and purchase invoice uploaded before.

15. Select Upload To GST option available on the top.

16. Login to GST Portal and file GSTR 3B Return.

Using auto mode the taxpayer can file the GSTR 3B hassle-free within few seconds and can also void from non-compliance of the provision for not filing the GST Return as prescribed under GST Act. The autoTax is a Masters India Product which is made with the perspective of simplifying the GST compliance for the user.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement