Know GSTR-8 Information in Brief

GSTR-8 is a monthly t that has to be filed by the taxpayer who collects the tax at source. In this article we will discuss about GSTR-8 in brief.

Points covered

1. What is GSTR 8?

GSTR-8 is a return that shall be filed by the e-com operators collecting tax at source. Moreover, GSTR-8 consists of all the details of supplies made through an e-com operator, TCS amount collected on such supplies and so forth.

2. Who shall file GSTR-8?

GSTR-8 has to be filed by every e-commerce operator who is registered under GST. As per the GST Act, an e-commerce operator is a person who owns a digital platform through which he carries out e-commerce activities, for instance, Flipkart. Therefore, obtaining GST and TCS registration is compulsory for the e-commerce operator to carry out the e-commerce activities hassle-free.

3. Who is an e-commerce operator?

In a layman language, an e-commerce operator is a person who provides a digital platform using which the seller can reach out to the customer by registering on their platform. The benefits of this digital platform are that the customer can buy any product at a competitive price on a single click and the seller can list their product on it that will reach out to the worldwide customers.

4. GSTR-8 Due Date

The due-date of GSTR-8 is the 10th of the subsequent month. Let us understand with an example, the GSTR 8 due date for the month of December will be on the 10th of January.

5. Consequences for not filing GSTR-8

In case if the GSTR-8 is not filed on time then there is a penalty of 200 INR per day that includes 100 INR CGST and 100 INR SGST/UTGST. However, the maximum amount of penalty that is applicable to the taxpayer is 5,000 INR.

In addition to the late fee, 18% interest GSTR-8 applicability per annum is also levied on the taxpayer and the amount of such interest is calculated on the amount of the tax that is yet to be paid.

Further, the late fee and interest will be applicable from the next day of the GSTR 8 due date .

Note: No GSTR 8 late fees is applicable on the IGST in case of delayed filing of GSTR-8.

6. Is it possible to revise GSTR-8?

The taxpayer filing GSTR-8 Form shall keep this in mind that it cannot be revised once filed. Howsoever, such errors can be rectified by him/her in the next month GSTR-8.

Let us understand this with an example:

If a taxpayer has made an error while filing GSTR8 of the month of June then such error can be rectified in the GSTR-8 of July month or any later month in which such error is identified.

7. Details furnished in GSTR-8 Form

Form GSTR-8 has 9 sections in total and they are:

a) GSTIN

In this section of the form the taxpayer has to provide GSTIN and in case if he does not have any GSTIN Provisional ID can be used.

b) Registered Person Legal Name and Trade Name

This column of the GSTR-8 form gets automatically populated at the time when he logs into the GST Portal.

c) Supplies details made through e-com operator

In this part of GSTR-8 Form, the e-com operator has to provide the information related to the supplies made by an e-commerce operator such as:

- Supplies details that attract TCS

- GSTIN of the supplier

- Amount of tax collected at source

d) Any rectification of supplies details in respect of any earlier month return

In this part of GSTR-8 Form, the taxpayer can amend earlier month mistakes in the supplies made to a registered person or an unregistered person.

e) Interest Details

This column of the GSTR-8 Form discloses the amount of interest levied on the e-commerce operator that arose due to late filing of GST 8 Return.

f) Tax payable and paid

Under this column the e-commerce operator has to disclose the total amount of tax payable and tax paid that is further bifurcated into different heads such as IGST, CGST and SGST/UTGST respectively.

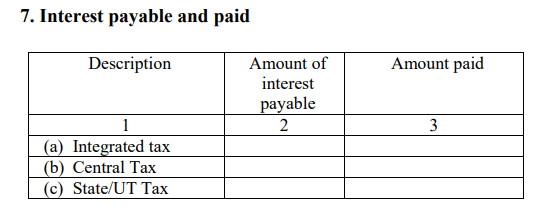

g) Interest payable and paid

In this head, the e-commerce operator has to furnish the details regarding the interest levied on him for late filing of GSTR-8 Form that is calculated on the outstanding tax amount.

h) Refund claimed from electronic cash ledger

The e-commerce operator has to mention the amount of refund claimed form electronic cash ledger in this part of GSTR-8 Form. Howsoever, it shall be kept in mind that the refund can be claimed only after the TCS liability has been discharged for that tax period.

i) Cash ledger debit entries for TCS or interest payment

This part will get auto-populated after filing GSTR-8 after the TCS amount is filed in the Part-C of GSTR-2A Form.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement